2025-03-14 03:07:34 pm | Source: Geojit Financial Services Ltd

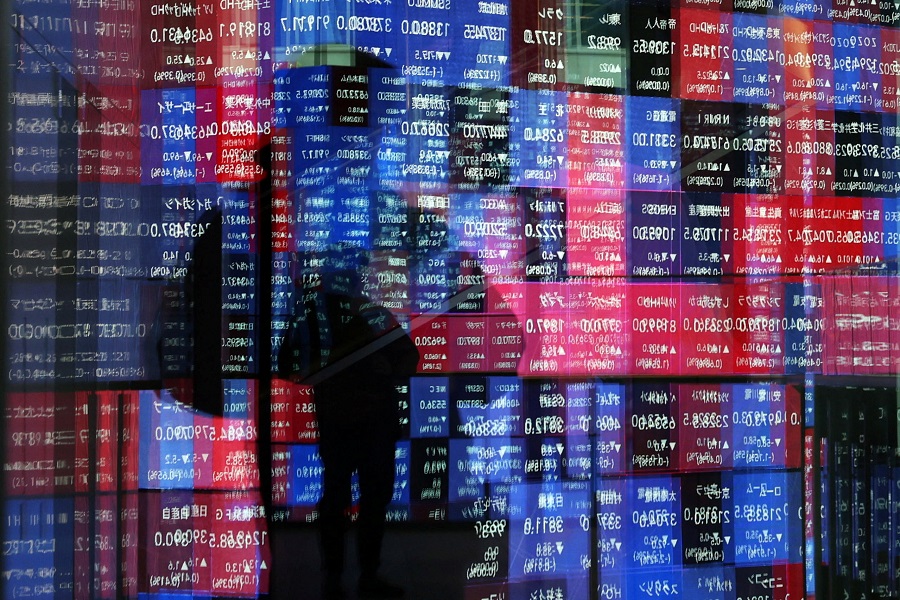

Weekly market outlook : Global Trade War Pressures Markets, Domestic Factors Offer Relief says Vinod Nair, Head of Research, Geojit Financial Services

Below the Quote on weekly market outlook from Vinod Nair, Head of Research, Geojit Financial Services

"The escalating global trade war has weighed heavily on market sentiments worldwide, creating uncertainty and causing indices to trade within a narrow range. However, domestic factors have provided some relief. The resilient Indian economy is showing positive signs of recovery, driven by a moderation in inflation and improvements in economic fundamentals. Retail inflation in India eased more than anticipated, raising hopes for interest rate cuts. Additionally, industrial output in January exceeded expectations, lifting market sentiment and preventing further declines. This recovery is supported by increased government spending and rising consumer incomes in FY26.

Persistent uncertainties surrounding global trade and the fear of a U.S. recession may continue to influence the domestic market's momentum. However, the moderation in valuations following recent corrections, along with supportive factors such as falling crude oil prices, an easing Dollar Index, and expectations of a rebound in domestic earnings in the coming quarters, may limit the volatility and is expected to contribute to a stability amid prevailing trade uncertainties. Looking ahead, next week's release of China's retail sales growth data and industrial production data will provide a clearer understanding of the Chinese economic growth outlook. Investors will also be closely monitoring US retail sales and production numbers."

Above views are of the author and not of the website kindly read disclaimer

Disclaimer:

The content of this article is for informational purposes only and should not be considered financial or

investment advice. Investments in financial markets are subject to market risks, and past performance is

not indicative of future results. Readers are strongly advised to consult a licensed financial expert or

advisor for tailored advice before making any investment decisions. The data and information presented

in this article may not be accurate, comprehensive, or up-to-date. Readers should not rely solely on the

content of this article for any current or future financial references.

To Read Complete Disclaimer Click Here

Latest News

Buy ICICI Prudential Life Insurance Ltd for the Targ...

Art, Architecture, and History: Pillars of Cultural ...

Budget 2026 may propose Banking Governance Bill to p...

Buy Canara HSBC Life Insurance Ltd for the Target Rs...

Equitas Small Finance Bank rises on reporting 36% ri...

Meesho surges on incorporating Wholly Owned Subsidiary

MCX Natural gas Feb is expected to rise towards Rs.3...

Hindustan Aeronautics rises on signing contracts wit...

India can sustain 'J curve' gains using trade divers...

Indian Hotels Company gains on opening Taj Gangtey R...

More News

Quote on Market Morning Inputs 11 June 2025 by Shrikant Chouhan, Head Equity Research, Kotak...

Quote on Morning Market Views 09th September 2025 by Dr. VK Vijayakumar, Chief Investment Strategist, Geojit Investments Limited

Quote on Pre-Market Comment 02nd January 2026 by Aakash Shah, Technical Research Analyst, Choice Broking Ltd

Quote on Daily Market Commentary for December 09th 2025 by By Siddhartha Khemka - Head of Research, Wealth Management, Motilal ...