Weekly Market Analysis : Markets ended a 4-week-long gaining streak and lost over 2% Says Mr. Ajit Mishra, Religare Broking

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

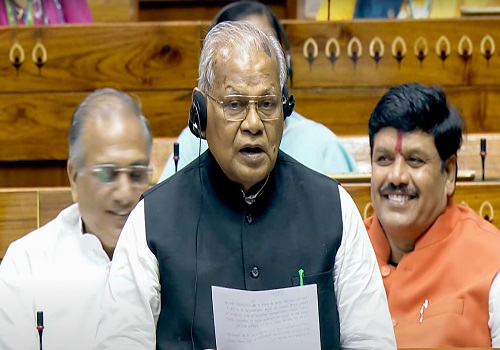

Below the Quote on Weekly Market Analysis by Mr. Ajit Mishra, SVP - Technical Research, Religare Broking Ltd

Markets ended a 4-week-long gaining streak and lost over 2%. The tone was negative from the beginning and a sharp cut in the middle pushed the benchmark indices below their immediate support i.e. 20 DEMA. The move was subdued in the following sessions, tracking mixed cues. Eventually, both benchmark indices, Nifty and Sensex, closed near the week’s low at 22,023.35 and 72,643.40 levels. All the key sectors, barring IT, ended in the red wherein realty, metal and energy were among the top losers. The broader indices extended their underperformance and witnessed a severe decline in the range of 4.7%-5.5%.

In the coming week, participants will continue to take cues from the global markets, in the absence of any major event onthe domestic front. The major index, the Dow Jones Industrial Average (DJIA) is hovering in a narrow range i.e. 38500-39,300 ahead of the FOMC meet and a decisive break on either side would dictate the short term trend.

Indications are in favor of further slide in the Nifty index, after the break of dual support viz. short term moving average i.e. 20 DEMA and a rising trendline on the daily chart. And, a breakdown below the previous swing low i.e. 21,850 could result in the next leg of down move to 21,500. The view would be negated if it manages to cross and hold decisively above the 22,250 level. Among the key sectors, IT and FMCG look comparatively stronger while others may continue to trade mixed. Amid all, we reiterate our preference for index majors and suggest maintaining positions on both sides. Besides, we advise traders to refrain from adding to the loss-making positions, especially in the midcap and smallcap space and wait for some sign of a reversal.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Markets moved down further on Thursday after the weakness seen in the afternoon session of T...

More News

Market Macros by Shrikant Chouhan, Head Equity Research, Kotak Securities