Weak economic data from the US restricted further downside in bullion prices - ICICI Direct

* MCX gold prices edged lower by 0.90% on Friday after Mr Powell said the Fed will continue its hawkish monetary policy until inflation moderates to around 2% annually

* However, weak economic data from the US restricted further downside in bullion prices

* MCX gold prices are expected to trade with a negative bias for the day amid strong US dollar. MCX Gold prices likely to break the support of | 51,150 to continue its downward trend towards the level of | 50,900

* Additionally, silver prices will take cues from gold prices and are expected to trade towards the level of | 54,000

MCX Gold vs Silver Performance

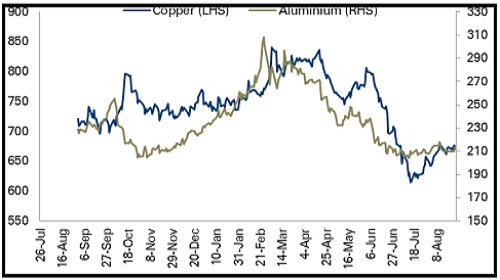

Base Metal Outlook

* MCX copper prices eased on Friday after touching their highest in nearly two months after the head of the US Federal Reserve doubled down on more interest rate hikes and warned that it would be painful

* However, further downside was restricted by a drop in copper LME warehouse inventories

* MCX copper prices are expected to rise for the day amid continuous drop in copper LME warehouse inventories. It is likely to trade in the range of | 677 to | 687 in the coming session

MCX Copper vs. Aluminum Performance

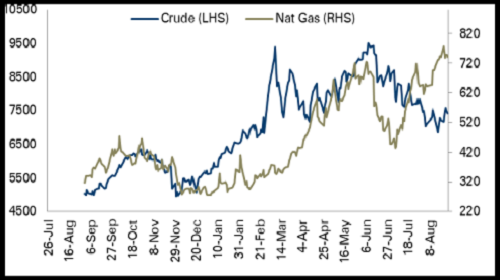

Energy Outlook

* MCX crude oil prices tumbled by 0.75% on Friday as investors braced for the possible return to global markets of sanctioned Iranian oil exports

* Further, crude oil prices were pressurised on worries that rising US interest rates would weaken fuel demand

* We expect MCX crude oil prices to trade with a negative bias for the day as Chinese offshore oil and gas major CNOOC, expects its annual domestic crude oil production to reach 1.2 million barrels per day by 2025, 28% above its current level

MCX Crude Oil vs. Natural Gas Performance

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

Above views are of the author and not of the website kindly read disclaimer

.jpg)

.jpg)