We’re raising capital for cell manufacturing, research & development: Ola Electric

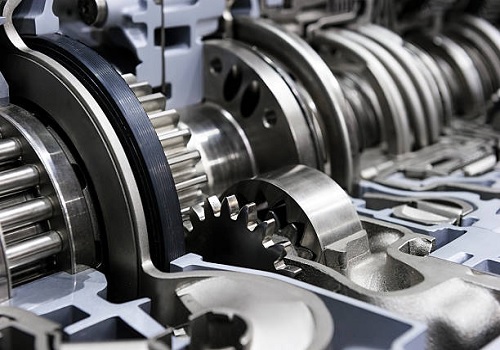

Ola Electric Mobility on Monday said they are raising capital via an initial public offering (IPO) to invest in cell manufacturing and further research and development.

The Bhavish Aggarwal-led EV company will also use the IPO funds for repayment of borrowing and spending on organic growth purposes.

Ola Electric aims to raise Rs 5,500 crore in primary issue and Rs 645.6 crore via offer for sale (OFS) from promoter entities and investors.

Harish Abichandani, Chief Financial Officer of Ola Electric Mobility, said that they "are raising capital for cell manufacturing and research and development".

"All these get factored in terms of the cash flows generated in the future. As we scale up, the path to profitability is faster," he said.

"Our capex is largely well-funded, both for the auto and the cell side," Abichandani noted.

More than half of the proceeds from the IPO will be used for capital expenditure and investing in R&D, according to the company's red herring prospectus (RHP).

Aggarwal said that they are focused on bringing EVs to the mass market and "we do expect mass market products to penetrate deeper into the small towns and villages".

"The company is young, and we wanted to bring this company to market early because of its Indian manufacturing story," he added.

Ola Electric is set to offer shares in the price band of Rs 72-76 in its IPO that will open for subscription on August 2 and close on August 6. Around 10 per cent of the IPO will be reserved for retail investors.

Promoters Aggarwal and Indus Trust will sell 3.79 crore and 41.79 lakh shares, respectively. Other investors in the EV firm, like SVF II Ostrich (DE) LLC, Alpha Wave Ventures II LP, Alpine Opportunity Fund VI LP, Internet Fund III Pte, Matrix Partners India Investments III LLC and Ashna Advisors LLP, will also offload their shares via the OFS route.