Union Budget FY27 Expectations Report by CareEdge Ratings

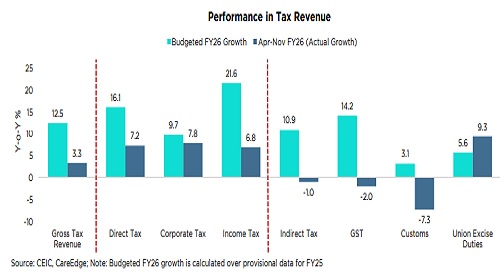

* Gross tax collections have been subdued in the fiscal year so far, up by just 3.3% (y-o-y) in 8M FY26, much lower than the budgeted growth of 12.5%.

* Direct tax collections have lagged in the year so far, with growth in corporate and income tax collections being lower than the budgeted annual growth.

* However, income and corporate tax growth have shown some improvement in the recent months.

* GST collections have contracted by 2% during 8M FY26, weighed by rationalisation in the GST structure implemented at the end of September.

* Among other indirect taxes, customs duty collections have contracted, whereas union excise duty collections have recorded a healthy growth in the fiscal year so far

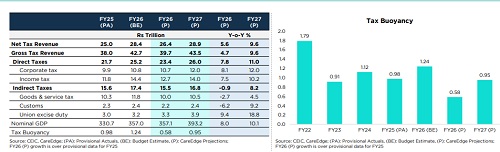

* Factoring the weaker tax performance in the fiscal year so far, we estimate the gross tax collections to witness a shortfall of Rs 3 trillion in FY26.

* Both direct as well as indirect tax collections are estimated to undershoot the budget estimate in FY26.

* Gross tax revenue is projected to improve in FY27, rising by 9.6%, marginally lower than the projected nominal GDP growth of 10.1%. We expected tax buoyancy at 0.95 in FY27.

* Direct tax collections are expected to see some improvement in FY27, aided by recovery in income and corporate tax collections.

* While GST rate rationalisation is expected to weigh on the collections, GST revenues are likely to see some improvement in FY27.

* Excise duty on tobacco products effective from 1 February 2026 is expected to support the growth in union excise duty collections in FY27

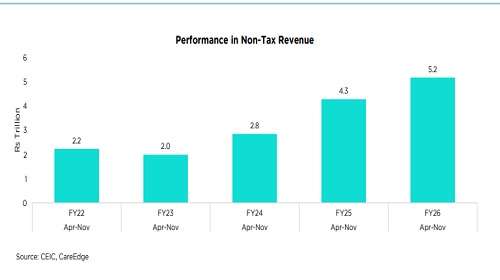

* While tax collections have shown a subdued performance in the current fiscal, the non-tax revenues have risen by a strong 20.9% during 8M FY26.

* With higher-than-expected dividend transfer by RBI, we expect the non-tax revenues to overshoot the budgeted amount of Rs 5.8 trillion, by Rs 0.3 trillion in FY26.

* We estimate the RBI dividend transfer to remain high in the range of Rs 2.0-2.5 trillion in FY27 compared to Rs 2.7 trillion in FY26.

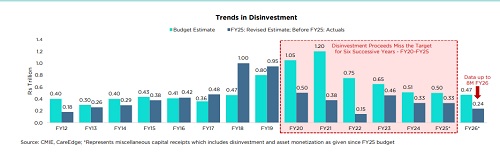

* Disinvestment has been lacklustre this fiscal at just Rs 49 billion (8M FY26) as against budgeted miscellaneous capital receipt of Rs 470 billion (includes disinvestment and asset monetisation).

* However, asset monetisation (Rs 188.4 billion during 8M FY26) offered some support to the miscellaneous capital receipts.

* We estimate a slippage of Rs 0.2 trillion in the total non-debt capital receipts, based on the assumption that the IDBI disinvestment and LIC stake sale is likely to be deferred to the next fiscal.

* With Centre having repeatedly underachieved its disinvestment targets, a fresh look at disinvestment strategy remains critical to support further fiscal consolidation.

Above views are of the author and not of the website kindly read disclaimer

.jpg)