Tide enables bill payments for SMEs to streamline expenses

Tide1 in India, the business financial platform has launched a Bill Payments feature in partnership with Setu powered by Bharat BillPay, by National Payments Corporation of India (NPCI). The feature will provide a hassle-free, interoperable and accessible bill payments service to micro, small and medium enterprises (MSMEs) across India. To keep operating spends minimal, small business owners (typically employing 0-10 people) often end up using their personal account for personal and business spends, which invariably creates an accounting nightmare and reduces visibility on business expenditure. Tide Billpay will solve this common pain point for small business owners.

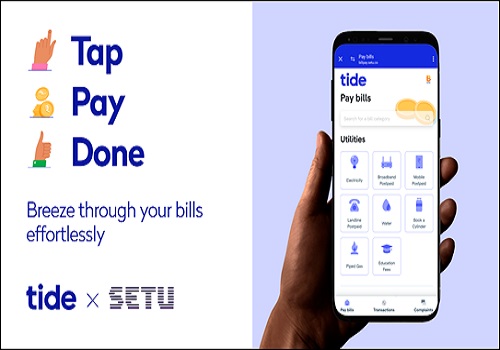

MSMEs face daily challenges paying business related bills. Tide’s Bill Payments will help MSMEs pay for a wide range of utilities, including electricity, gas, postpaid mobile and broadband bills as well as insurance premiums, loan instalments and municipal tax directly from Tide’s mobile app. Bill Payments will provide quicker, more convenient and secure payments to small business owners. Users can choose from several payment methods that the Bharat Bill Payment System offers.

Tide Members (customers) will be able to track and trace their business-related payments and use the transaction history to easily identify categories of outgoing expenses for their business. This will give them a deeper and more holistic view of their cash-flow and therefore the short and long-term health of their business.

The feature employs cutting-edge security methods, such as encryption and authentication. Bill Payments facilitates transparency, as users receive immediate confirmation of the payments. Members can access the new Tide feature 24/7 and will be able to make payments anytime, from anywhere.

Kumar Shekhar, Deputy Country Manager, Tide in India, said: "India’s dynamic SMEs fuel the country’s economic growth. Tide stands at the forefront of innovation to help them save time and money. Our Bill Payments feature alleviates the pain point that bill settlements pose for small business owners. With a focus on agility, convenience, ease of use, security and accessibility, we are committed to help simplify the bill payments experience for India’s MSMEs.”

Tide aims to on-board half a million SMEs in India by the end of 2024. Tide is working to create a sizeable business in India, in the belief that the market represents a substantial opportunity. The company plans to introduce a host of other features for small businesses across India. These include a Business Savings/Current Account, bank transfers, GST, pay by link and credit services. Tide is working to bring the richness of its product offering in the UK to India, while tailoring it to the needs of MSMEs in India.

As a digital-only service, the Tide business account can be opened anytime and anywhere in India. The Tide app is now available on the Google Play Store, for Android devices.

Explore Tide’s Bill Payments feature: https://youtu.be/sKmJW22iyNc

Above views are of the author and not of the website kindly read disclaimer

More News

PM Narendra Modi`s return to power will keep markets in strong position: Ace global investors