Technical Forecast 17th November 2025 by Vaishali Parekh, Vice President - Technical Research at PL Capital

Below the Technical Forecast 17th November 2025 by Vaishali Parekh, Vice President - Technical Research at PL Capital

Forecast

NIFTY / SENSEX

Nifty once again witnessed a highly volatile session, sustaining the support at the 25750 zone, and with a last-hour spurt indicated, closed above the 25900 zone with the bias overall maintained intact, and we can expect a further upward move in the coming days with targets of 26300 and 26700 levels with the undertone maintained strong. The index has sustained the fluctuations, and with the near-term support zone positioned near the 25700 level, one can expect further gains. Sensex continues to gain strength, sustaining above the important 20DMA level, which is positioned near the 84130 zone, maintained as the strong near-term support, and currently closing above the 84550 level has further improved bias and sentiment overall. With the broader markets supporting the benchmark index, on the upside, Sensex needs to breach above the important hurdle of the 85200–85300 zone, which shall establish further stability and conviction for further upward movement in the coming days. The support for the day is seen at 25800 levels, while the resistance is seen at 26100 levels.

BANKNIFTY / BANKEX

BankNifty once again maintained the support near the 58100 zone, witnessed fluctuations, and in the final hours surged ahead to end near the 58500 level with bias remaining positive. The index overall continues to remain rangebound, and as mentioned earlier, it would desperately need to breach above the tough barrier of the 58500 level to trigger a breakout, with the important and crucial support positioned near the 50EMA at the 56800 level, which needs to be sustained. Bankex has sustained above the important support near the 20 DMA level of 65250 since the last 3 sessions, and the indication of a pullback to close just near the 65650 zone has once again improved the bias to anticipate a further upward move in the coming days. The index would continue to have the important support positioned near the 64700 level, and at the same time, on the upside, a decisive breach above the resistance zone of the 65800 level shall fresh higher targets of the 67700 and 68300 levels in the coming days. BankNifty would have the daily range of 58000-59000 levels.

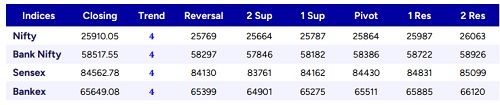

Nifty / BankNifty / Sensex / Bankex - Daily Technical Levels

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271