Stocks in News & Key Economic Updates 14th January 2026 by GEPL Capital Ltd

Stocks in News

* OLA ELECTRIC MOBILITY: The company has re-launched the Ola Muhurat Mahotsav campaign from January 14, offering customers benefits of up to Rs.1 lakh on Ola Shakti model products.

* ANAND RATHI AND STOCK BROKER: Anand Rathi International Ventures will enter the investment and merchant banking business in GIFT City, with the arm also undertaking the company’s investment advisory operations from the GIFT City platform.

* ENDURANCE TECH: The company is eligible to receive incentives of Rs.859 crore, an increase of Rs.252 crore from Rs.606 crore earlier, related to investments made at its Waluj unit, to be availed in the form of Industrial Promotion Subsidy.

* INTERATECH BUILDING SOLUTION: The company has received a Rs.130 crore order from a customer to manufacture a pre-engineered steel building system.

* REDTAPE: The company has denied reports of talks regarding a founders’ stake sale, clarifying that no negotiations for such a transaction have taken place.

* FIRSTSOURCES SOLUTION: The company’s arm has acquired a 100% stake in Telemedik for a consideration of up to USD 3 million, including earn-out payments.

* PAYTM: The company has completed the acquisition of a 100% stake in Fincollect Services from Urja Money and has also incorporated a new arm, Paytm Europe Payments SA.

* NCLT: The company has entered into an agreement with the Gujarat government to develop large-scale renewable energy projects.

* MTNL: Sunil Kumar Ranjan has been appointed as a government nominee director on the company’s board with immediate effect for a three-year term.

Economic News

* Budget 2026 may be high on highways: Faster clearances, InvIT push expected: India's national highway network has surged by over 61% to 146,560 km, driven by the Bharatmala Pariyojana. The government plans a Rs 2.87 lakh crore budget for 2025-26, focusing on access-controlled highways and a Rs 8.3 lakh crore PPP pipeline. A public InvIT, Raajmarg InvIT, will also be launched to fund future development.

Global News

* Global Growth Resilient but Uneven, with Advanced Economies Driving a Fragile Recovery: The World Bank says the global economy is more resilient than expected, with the 2026 GDP growth forecast marginally upgraded, but warns that growth remains weak and uneven, concentrated largely in advanced economies and insufficient to reduce extreme poverty. Global growth is seen easing to 2.6% in 2026 before recovering to 2.7% in 2027, with upward revisions driven mainly by stronger-than-expected U.S. growth despite tariff-related trade disruptions. However, the 2020s are shaping up to be the weakest growth decade since the 1960s, leaving many emerging and developing economies behind, even as global per-capita GDP has rebounded sharply since COVID. Emerging markets’ growth is expected to slow, excluding China remains flat, China’s growth moderates despite stimulus support, while Europe and Japan face slower momentum due to tariffs, weak consumption, and investment, highlighting a structurally fragile and increasingly uneven global recovery.

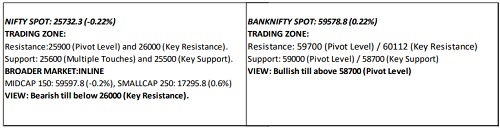

Technical Snapshot

Key Highlights:

Government Security Market:

* The Inter-bank call money rate traded in the range of 4.50%- 5.55% on Tuesday ended at 5.40%.

* The 10 year benchmark (6.48% GS 2035) closed at 6.6277% on Tuesday Vs 6.6050% on Monday .

Global Debt Market:

The benchmark 10-year Treasury yield ticked higher on Tuesday as investors await key inflation data that will offer crucial insights on the health of the U.S. economy. The 10-year Treasury yield edged higher by less than 1 basis point to 4.197%. The 30-year bond yield also rose less than a basis point to 4.85%. One basis point is equal to 0.01%, and yields and prices move in opposite directions. The consumer price index report due later in the morning is expected to offer a clearer read on inflation following distortions caused by last autumn’s prolonged U.S. government shutdown. Economists forecast prices to have increased 2.7% in the year through December, in line with Dow Jones consensus estimates, matching November’s softer-than-anticipated inflation print. Markets are closely watching the data after December’s jobs report pointed to a labor market that is cooling modestly but remains resilient, reinforcing expectations that the Federal Reserve will delay interest-rate cuts. Futures markets currently price in two quarter-point cuts this year beginning in June, according to the CME FedWatch tool. Federal Reserve Chair Jerome Powell said on Sunday evening that the Justice Department has opened a criminal investigation into him over the $2.5 billion renovation of the central bank’s Washington headquarters. Powell warned that the outcome of the investigation will determine the future of the central bank’s decisions.

10 Year Benchmark Technical View :

The 10 year Benchmark (6.48% GS 2035) yield likely to move in the range of 6.61% to 6.63% level on Wednesday.

SEBI Registration number is INH000000081.

Please refer disclaimer at https://geplcapital.com/term-disclaimer

More News

Quote on Nifty 26th February 2026 by Rupak De, Senior Technical Analyst at LKP Securities