Spot USDINR little changed at 83.73, another day of lacklustre trade - HDFC Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Market Roundup

* On Wednesday, the dollar index had its worst day since May, supporting a rally in emerging markets and Asian currencies excluding the yen, which rallied against the greenback. The rebound in crude oil prices and foreign fund outflows could push the rupee lower in the near term.

* Spot USDINR little changed at 83.73, another day of lacklustre trade. However, it closed at a record low. Technical setup remains bullish for the USDINR, but the higher side is capped around 83.85 while 83.60 remains strong support on the downside.

* Markets are pricing a roughly 50-50 possibility that the BOE may start cutting rates, which could weigh on the pound.

Market Updates:

* The US dollar fell after the Federal Reserve left its policy rate unchanged at 5.25-5.50%, with Chair Jerome Powell noting in a press conference that an interest-rate cut could come as soon as September.

* Federal Reserve Chair Jerome Powell signalled that the central bank officials are on course to cut interest rates in September unless inflation progress stalls, citing risks of further labour-market weakening.

* Interest-rate swaps showed traders have fully priced in a quarter-point cut in September — and a total of almost 70 basis points worth of reductions for the year.

* The BOJ raised its policy rate to around 0.25%; Governor Kazuo Ueda cited a weak yen as a risk factor for rising inflation and suggested that the central bank could raise rates beyond 0.5% if necessary, underscoring his determination to normalise monetary policy.

* China’s manufacturing activity unexpectedly shrank for the first time in nine months in July. The Caixin manufacturing purchasing managers index fell to 49.8 last month from 51.8 in June, according to a statement released by Caixin and S&P Global Thursday.

* West Texas Intermediate rose early Thursday in commodities to compound its 4.3% advance Wednesday, the biggest daily jump in over two years. Gold was steady after touching a record high on Wednesday.

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ000171337

Top News

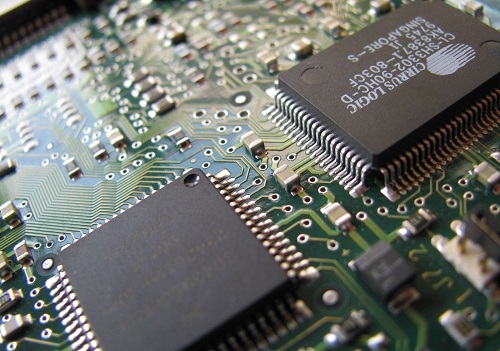

India to consume semiconductors of $80 billion to manufacture electronics worth $300 billion...

Tag News

Natural Gas Hits Fresh Swing High as Winter Blasts Begin, EIA Draw - HDFC Securities Ltd