Shriram Life Insurance Reports 21% YoY Growth in Individual New Business Premium in Q1FY26

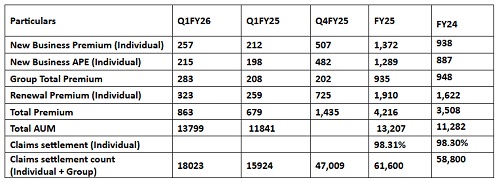

Shriram Life Insurance Company Ltd reported a 21% year-on-year growth in Individual New Business Premium (NBP) in the first quarter of fiscal 2026, driven by a broader distribution footprint, higher average ticket size, and branch expansion. The NBP grew from Rs.212 crore in Q1FY25 to Rs.257 crore in Q1FY26.

For Q1FY26, the average ticket size, or the average premium amount per policy sold, for individual policies stands at Rs.24,799. It was Rs.15,192 in Q1FY25. In comparison, the average ticket size for the private industry for Q1FY26 is Rs.87,373.

This growth in average ticket size is also reflected in the Individual New Business APE (Annualized Premium Equivalent), which rose 9% year-on-year to Rs.215 crore in Q1FY26, up from Rs.198 crore in Q1FY25 Renewal premium across individual business rose by 25% year-on-year, reaching Rs.323 crore in Q1FY26 from Rs.259 crore in Q1FY25. Total premium for Q1FY26 rose 27% year-on-year to Rs.863 crore from Rs.679 crore.

SLIC’s Assets Under Management (AUM) grew 17% to Rs.13,799 crore in Q1FY26 from Rs.11,841 crore in Q1FY25. The company sold 86,750 policies in Q1FY26. The solvency ratio for the quarter stands at 1.75.

Casparus J.H. Kromhout, MD and CEO, Shriram Life Insurance, said, “Shriram Life Insurance is guided by a clear vision — to deepen its presence in rural and semi-urban markets and reach every corner of the country. Our strategy is focussed on making life insurance simpler and more accessible for everybody we serve.”

During the first quarter of FY26, the company settled 18,023 claims in both individual and group policies compared with 15,924 claims in the same period last fiscal. In FY25, the company settled 98.31% of individual claims, with 93% of all non-investigated claims settled within 12 hours of receiving the last document.

SLIC has been systematically deepening strategic partnerships to broaden its reach into the remotest corners of the country and reinforcing its commitment to financial inclusion.

"We believe protection should not be a privilege, but a basic financial right for every Indian household — no matter where they live or what they earn. That’s why these partnerships matter," said Kromhout.

Above views are of the author and not of the website kindly read disclaimer

More News

Jammu&Kashmir, Ladakh linked by tourism, want both to grow together: Omar Abdullah government