Sell JPYINR Dec @ 59 SL 59.2 TGT 58.8-58.6 - Kedia Advisory

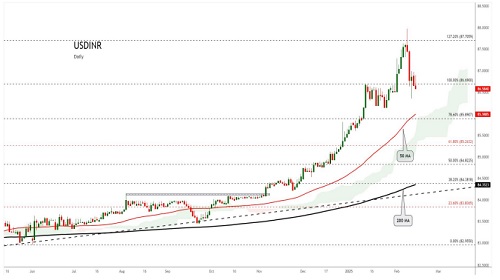

USDINR

SELL USDINR DEC @ 91.1 SL 91.3 TGT 90.9-90.7.

Observations

USDINR trading range for the day is 90.69-91.37.

Rupee hits record low on dollar demand, NDF maturities, and portfolio outflows.

India Manufacturing PMI eased to 55.7 in December 2025 from 56.6 in November, marking the weakest improvement in manufacturing conditions since December 2023.

India’s Unemployment rate falls to 4.7% in November, lowest since April

EURINR

SELL EURINR DEC @ 107.15 SL 107.45 TGT 106.8-106.6.

Observations

EURINR trading range for the day is 105.4-108.32.

Euro climbed bolstered by broad dollar weakness, firmer rhetoric from European Central Bank officials, and progress on France’s 2026 social-security budget.

Euro zone industrial production increased by 0.8% in October from the previous month.

German inflation rose to 2.6% in November, the federal statistics office said.

GBPINR

SELL GBPINR DEC @ 122.2 SL 122.5 TGT 121.9-121.7.

Observations

GBPINR trading range for the day is 121.15-122.67.

GBP steadied amid broad US dollar weakness as traders prepared for the Bank of England’s monetary policy decision.

The UK trade deficit widened to £4.82 billion in October 2025, up from £1.09 billion in September, marking the largest gap since February.

Manufacturing production in the UK rose by 0.5% month-on-month in October 2025, rebounding from a 1.7% fall in September

JPYINR

SELL JPYINR DEC @ 59 SL 59.2 TGT 58.8-58.6.

Observations

JPYINR trading range for the day is 58.53-59.23.

JPY gains amid firming BoJ rate hike expectations and the cautious market mood.

The S&P Global Japan Manufacturing PMI rose to 49.7 in December 2025 from 48.7 in November, marking its highest level since August.

Japan’s S&P Global Services PMI fell to 52.5 in December 2025 from a final 53.2 in the previous month, marking the lowest reading since June.