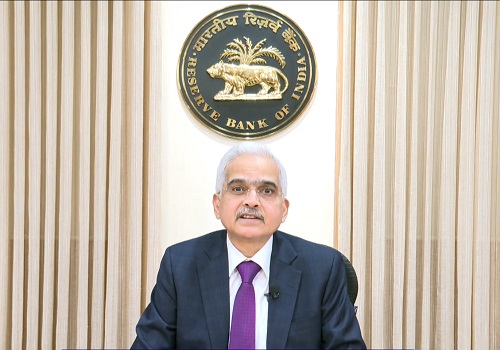

SBICAPS Report on RBI MPC : taking guard again: playing to keep the local weather clear and sunny

MPC maintains status quo on rates and stance, both by a 4-2 vote (vis-à-vis 5-1 in the last policy)

In line with expectations, policy rates were kept unchanged, with the Repo at 6.50%, with the stance retained as "withdrawal of accommodation." Shifts in voting patterns suggest a growing cohort within the MPC advocating for evolution of policy discourse. Ongoing transmission to lending rates, last mile of disinflation, and disjointing the stance and liquidity conditions support these decisions. Thereby, we anticipate the first rate cut only in late CY24, as the RBI plays according to the local weather (ensuring disinflation and sustaining growth) while keeping an eye on the global horizon

Focus remains on preserving financial stability while anchoring inflation expectations

The confluence of effective monetary and fiscal policies led to a stellar real growth of 8.2% y/y in FY24. The economy is at an inflection point and materializing of the upwardly revised real growth projection of RBI of 7.2% (previous: 7.0%) in FY25 would mark 4th consecutive year of 7%+ growth. With enhanced fiscal buffers bolstered by RBI dividend amidst varying expectations from fiscal policy, expected agricultural recovery due to favourable monsoons, and anticipated pick-up in manufacturing capex as well as global trade, our confidence on FY25 real GDP forecast of 7% y/y grows. This robust growth is expected to support continued fiscal consolidation, with the fiscal deficit already narrowing to 5.6% of GDP in FY24, better than FY24RE

Effective monetary policy sets the stage for bringing inflation down at keeping it there durably

Stable inflation, aided by an ebbing Core, favourable base effects, bountiful monsoons, and moderating crude, aligns with the RBI maintaining previous projection of headline CPI averaging 4.5% y/y in FY25 (our forecast: 4.7%). Transitory shocks in food due to production and sowing patterns, particularly affecting TOP and pulses, warrant close monitoring. Separately, the RBI Governor was categorical that the inflation should not only decelerate but must remain there durably.

Conscious and nimble liquidity management and counter-cyclical measures garner focus of policyspeak

The liquidity situation is dynamic with LAF operations at multi-year highs. Once fiscal spending gains traction, with bond inclusion flows starting this month, the situation is expected to be calibrated more judiciously. Maintaining the WACR proximate to the midpoint of the corridor whilst enhancing the efficacy of monetary transmission continues to be a central objective. Additional counter-cyclical measures including higher contingency fund of RBI, proposing higher provisioning norms for project finance, raising risk weights for unsecured loans, and building tall forex buffers safeguard against financial shock.

Financial system continues to remain resilient; judicious use of regulatory freedom by the financial sector is required

While being eloquent about the resilience of financial ecosystem, reflected in strong balance sheets and enhanced asset quality, the Governor warned that the interest rates on small value loans are high and appear to be usurious in some MFIs and NBFCs. The importance of safeguarding customer interests was reiterated.

RBI builds sufficient forex buffers to keep the local weather sunny and external sector resilient

In FY24, CAD narrowed to ~1% of GDP, propelled by robust remittances and service exports, amidst the rapid expansion of GCCs. Despite recent FPI outflows and a moderation in net FDI, India remains an attractive destination for capital inflows. Confidence in managing external financing needs is underscored by record-high forex reserves of USD 651 bn, further bolstered by growth in ECB agreements, non-resident deposits, and potential bond inclusion flows. Due to above mentioned factors, the impact of US Fed monetary actions on India's resilient external sector and economic growth seems limited.

Key additional measures

* Review of limit of bulk deposits – upwardly revising the definition to Rs. 30 mn for SCB (excluding RRB) and SFB and Rs. 10 mn for RRB and local banks

* Rationalisation of guidelines for export and import of goods and services under FEMA to promote ease of doing business

* Setting up a digital payments intelligence platform- real-time data sharing across the digital payments’ ecosystem to ensure safety and security

With RBI committed to domestic narrative, G-Sec yields remained range bound

Status quo policy kept the yields range bound, with the 10Y Union G-sec remaining at last trading session’s level of 7.01%. Noteworthy, RBI remains steadfastly committed to the domestic narrative, explicitly stating that actions of US Fed might not warrant RBI following suit. Global monetary easing, continued fiscal consolidation, bond inclusion flows, cooling inflation, and anticipated rate cuts after late CY24, ensure the continued descent of 10-year yields below 7% over the medium term.

Above views are of the author and not of the website kindly read disclaimer