Report on Netra Early Signals Through Charts December 2025 Edition by DSP Mutual Fund

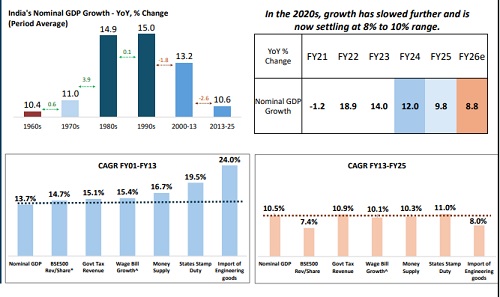

India’s Nominal Growth Downshifts

Nominal growth is an important marker. It conveys the pace of volume + price effects in the economy. Faster nominal growth is usually accompanied by a stronger phase of prosperity, in terms of incomes & employment, if inflation is not running hot.

India’s nominal growth has slowed significantly. From the Liberalization, Privatization and Globalization ‘LPG’ reforms of 1991 to 2014 nominal GDP growth was 14% on average. Since then, the nominal growth has been ~10% yoy.

In fact, since FY14, barring the COVID base effects led uptick, nominal growth hasn’t exceeded 12% yoy even once. Average nominal GDP growth in the 1990s was 15% yoy, this shifted a bit lower, but was very strong at 13.2% yoy in 2000-13 phase, but has since slipped to about 10.6% yoy.

When we look at what makes up as key drivers and markers of nominal growth – corporate sales, govt tax revenues, salaries & wages, money supply, stamp duty and core goods imports – all of them have shifted lower. Most of these drivers are now growing below nominal GDP growth trends.

Is 10% Nominal Growth Enough? Why Is It Anemic?

For India, 10% nominal GDP growth with core inflation at 4% (the RBI’s target) implies real growth of about 6%. That pace is probably not fast enough for India to fully harness its demographic dividend and extended favourableworking-age phase.

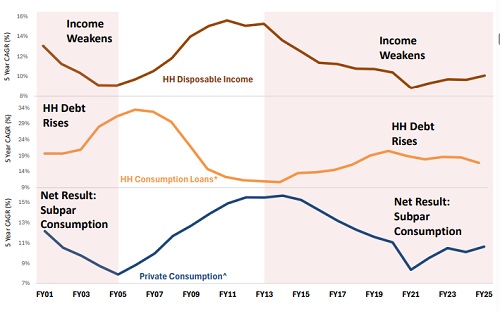

Why is nominal growth thissoft? It reflects weak consumption growth, a slowdown in services exports, a failure of goods exports to accelerate meaningfully, and an underwhelming, stopstart infrastructure and capex cycle.

Government spending and corporate capex have tilted towards consumption-oriented infrastructure rather than production-enhancing assets (think more urban metrosthan new freight corridors, for instance). This has caused a slowdown in the employmentsector causing wages to grow at a slower pace. In the aftermath of COVID, a combination of slower wage growth butstrong household debt accretion has made sure that consumption trends remain subpar.

This potential loop of poor consumption leading to lack of visibility has hit capex, which anyway was directed at non-production sectors. This needs a course correction, probably through difficult policy choices.

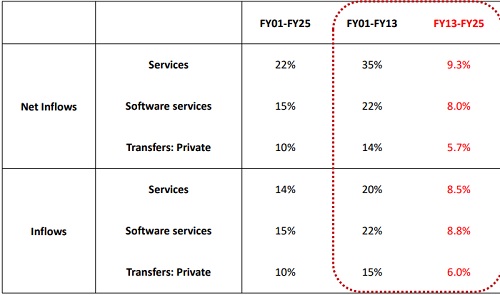

Services Exports Growth Has Halved

The brightest spot in India’s growth over the last two and a half decades is Services Exports. The full period growth CAGR for Net Services exports is a staggering 22%, probably one of the highest in the world.

The amount of prosperity, consumption demand and demand for housing that this large inflow of USD primarily led of India’s IT&ES sector has created is unprecedented and doesn’t have a runner up. A worrying trend is at display in this segment.

The Net Services Exports growth has slowed considerably. If you take the tale of two halves, divided by the FY13 twin balance sheet shock, the services sector has seen a dramatic slowdown in growth. Even after the slowdown, a USD annual growth rate of 8% to 9% remains a very strong number from a global perspective but falls short for India because of the heavy lifting it does for India’s external sector and domestic demand creation.

Above views are of the author and not of the website kindly read disclaime