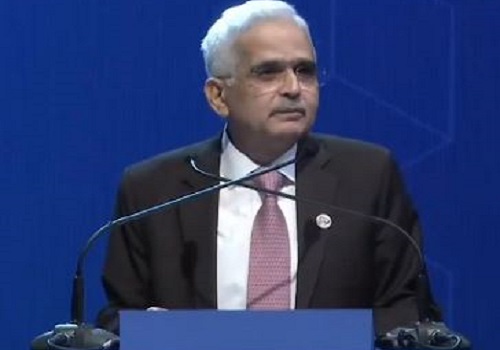

RBI Governor rules out immediate rate cut as inflation still a concern

Reserve Bank of India Governor Shaktikanta Das on Wednesday said that although the central bank had shifted towards a softer neutral monetary policy stance to spur growth, this did not mean that an interest rate cut would happen immediately.

Addressing a media event here, the RBI Governor said: "A change in stance doesn't mean there will be a rate cut in the very next monetary policy meeting."

He said there were still significant upside risks to inflation and "a rate cut at this stage would be very risky".

The RBI, at its monetary policy review, kept interest rates unchanged for the 10th straight meeting, but switched its monetary policy stance to "neutral" from "withdrawal of accommodation".

This had led to speculation that the way had been paved for an interest rate cut.

Das said that easing measures would only be considered once inflation sustainably falls to the RBI's 4 per cent target on a durable basis.

Inflation rose from 3.65 per cent in August to 5.49 per cent in September on the back of rising food prices.

At the same time, Das is bullish on the outlook for the Indian economy.

"I would not rush to declare that the economy is slowing down. The data coming in is mixed, but the positives outweigh the negatives. By and large, underlying economic activity remains strong," he remarked.

The RBI Governor cited the robust recovery in car sales during October as a positive sign, although he admitted that sales of fast-moving consumer goods in urban areas remained subdued.

Das also said that the non-bank financial companies (NBFCs) were in a robust state of health. He observed that regulatory action had been taken only in the case of four entities while there were about 9,400 NBFCs in the country. This action was corrective rather than punitive and aimed at protecting the interests of consumers, he added. He further stated that while banks need to exercise caution on the issue of unsecured loans, there is no evidence to suggest that these loans are being diverted to the stock markets.

Besides, Das said that the RBI will not launch the Central Bank Digital Currency (CBDC) in a hurry as the pilot project is still in an experimental stage.

The RBI is “still on the learning curve” as far as the digital currency is concerned, he added. "We are not in a hurry to launch the CBDC. We will launch it when we are fully satisfied," he remarked.

The wholesale CBDC, which was introduced in November 2022, is used to settle inter-bank transactions in government securities.