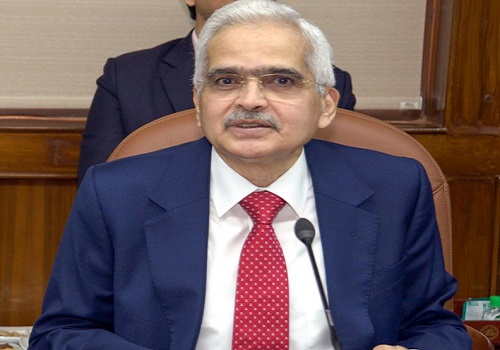

RBI constantly working on policies, platforms to make India`s financial system strong:Shaktikanta Das

Reserve Bank of India (RBI) Governor Shaktikanta Das has said that the central bank is constantly working on devising policies, systems and platforms that will make the country’s financial sector stronger, nimble and customer-centric. He also said that the Unified Payments Interface (UPI) system has the potential to evolve into a cheaper and quicker alternative to the available channels of cross-border remittances and a beginning can be made with small value personal remittances as it can be quickly implemented.

The governor said Digital Public Infrastructure (DPI) spurs market innovation by reducing transaction costs, democratising access, maintaining competition through interoperability, and attracting private capital. Referring to the country's experience, he said DPI has enabled India to achieve, in less than a decade, levels of financial inclusion that would have otherwise taken several decades or more. DPI refers to basic technology systems, created mainly in the public sector, which are openly available to users and other developers. India's DPI journey is a unique model, wherein the base technical infrastructure is built, operated and managed in the public sector, while the private sector accesses the DPI to create innovative customer facing services. The advantage of developing DPI in the public sector is that typically the private sector would be averse to capital investment to create infrastructure with uncertain returns. He added that privately created infrastructure may not also be amenable to democratised access or interoperability.

He further said UPI, a real-time payment system, has emerged as a robust, cost-effective and portable retail payment system and is attracting active interest across the globe. He said that by digitising access to the customer's financial and non-financial data that otherwise resided in disparate silos, Unified Lending Interface (ULI) is expected to cater to large unmet demand for credit across various sectors, particularly for agricultural and MSME borrowers. Based on the experience from the pilot project, he said a nationwide launch of the ULI will be done in due course.