Quote on RBI Monetary Policy detailed note by Ms. Namrata Mittal, Chief Economist, SBI Mutual Fund

Below the Quote on RBI Monetary Policy detailed note by Ms. Namrata Mittal, Chief Economist, SBI Mutual Fund

The Monetary Policy Committee cut the Repo rate by 25bps to 6.25% (SDF rate at 6.00%, MSF rate at 6.50%) in line with street expectation. The stance was retained at neutral which came in as a marginal disappointment to consensus expectation. The governor committed to ensure orderly liquidity conditions, although no additional measures were introduced today. Liquidity actions have often been taken outside the policy framework and are likely to continue in a similar manner. The decision to cut the repo rate while retaining the stance was unanimous among the MPC members.

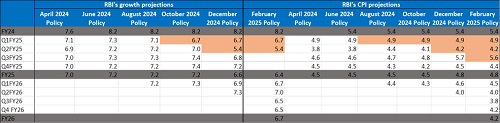

RBI’s growth estimates have been pared down

Growth projections for FY25 have been revised downward, from 7.2% in the June to October 2024 policy statement to 6.6% in December 2024, and now further to 6.4%. This marks the first policy in which the RBI has provided a full-year growth estimate for FY26, set at 6.7% (Q1: 6.7%, Q2: 7.0%, Q3 and Q4: 6.5% each), which aligns with our expectations. According to the RBI’s guidance, FY26 is expected to close with a growth rate of around 6.5%, falling short of the desired 7% target for the country. The first half of FY26 will likely reflect a base effect due to lower government spending. As a result, growth will likely play a more prominent role in shaping monetary policy decisions for 2025.

India’s retail inflation outlook creates an enabling environment to take growth supportive measures

Compared to recent policies, concerns over food inflation have eased slightly, helped by a recent decline in vegetable prices. However, the rising cost of imported energy poses a new risk for India. Overall, the projections suggest a positive outlook for retail inflation in the country. FY25 inflation is expected to be 4.8% (with Q4 projected at 4.4%). FY26 CPI is forecasted at 4.2% (Q1: 4.5%, Q2: 4.0%, Q3: 3.8%, Q4: 4.2%), with risks evenly balanced. The impact of a depreciating rupee on inflation has been factored in. CPI levels around 4% (or under 5%) provide a conducive environment for implementing growth-supportive measures.

RBI’s GDP and CPI projection across policies

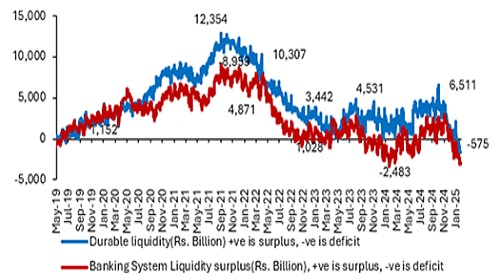

Liquidity support could continue outside the monetary policy

Banking system liquidity shifted into deficit during December 2024 and January 2025, after an extended period of surplus following the COVID-19 pandemic. The liquidity drain is primarily due to advance tax payments in December 2024, capital outflows, foreign exchange operations, and a notable increase in currency circulation in January. The RBI encourages banks to ramp up their lending in the uncollateralized call money market (i.e., actively trading among themselves) rather than passively parking funds with the RBI.

Banking system liquidity has moved into deficit since December

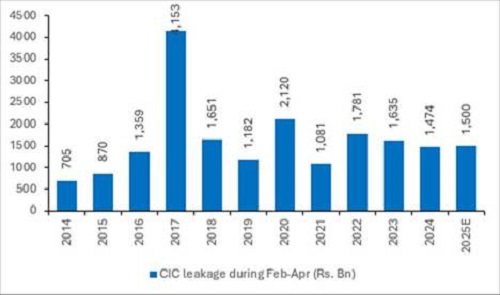

A sustained improvement in durable liquidity might have to wait till May

The RBI's comments on liquidity in the monetary policy statement were concise. However, we have observed several actions outside the policy, including long-dated VRR, on-tap VRR, OMO purchases, and FX buy-sell swaps in January 2025. With the potential for an additional Rs. 1.5 trillion in currency leakage from February to April, combined with near-term outlook around dollar capital flows, liquidity may remain in deficit despite these recent measures. It is also important to consider the RBI’s dividend transfer to the Central Government, which typically materializes in May each year and is expected to exceed Rs. 2 trillion this year (according to budget estimates). When spent, this will inject liquidity into the system. The central bank may not want to flip flop between liquidity actions and is likely to carefully weigh the pros and cons before implementing any further actions.

Currency leakage from the banking system is skewed towards Jan-Apr every year; Next three months could see Rs. 1.5 trillion of currency outflow

Delay in LCR implantation is another key notable

A few other notable announcements or statements included the acknowledgment that 'regulatory actions come with a cost,' a decision to review the forecasting models, and a nudge to banks to increase lending in the call money market. A key announcement for banks concerned the postponement of the LCR guidelines implementation, now scheduled for no earlier than April 1, 2026, and to be rolled out in a phased manner. Additionally, the RBI indicated that more time would be needed to finalize project financing norms and expected credit loss rules.

India is clearly on the path of monetary easing …

Monetary policy in India is easing since last few months. October policy saw the stance getting changed to neutral (vs. withdrawal of accommodation). This was followed with 50bps of CRR reduction in Dec’2024, plethora of liquidity supporting measures in January and now a 25bps of repo rate reduction in February 2025. We interpret the neutral stance as RBI desire to go extremely calibrated on future Repo rate actions, given the change in global dynamics, where the markets have significantly dialled down quantum of rate cuts by the US Fed in 2025. The fact that stance is neutral – means that everything that transmit between now and April -Q3FY25 GDP data, global dynamics, currency, crude, March heat waves- will matter. We are expecting 50bps of rate cutting cycle. Rate cuts transmit with a lag, so it makes sense to act with a forward looking estimate if the monetary policy has to work its way on real economy.

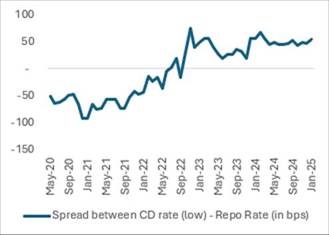

… but liquidity will play much larger role

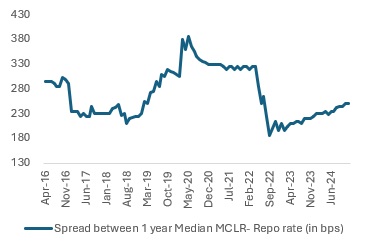

That said, as we have been repeatedly highlighting the need of the hour is liquidity actions more than a rate actions. Urjit Patel committee had once opined that it makes sense to keep liquidity in surplus during monetary easing and vice a versa for the transmission to be effective. Today even as policy rate was 6.5% until yesterday (and 6.25% now), MCLR for banks are around 9% and nearly Rs. 5 trillion of short-term funding (Certificate of deposit) is being sought at 7.40%-7.60%. The corporate bond spreads have also widened. Hence, there is a clear widening spread between cost of borrowing for the private sector vs. government which could likely sustain under the current liquidity backdrop. Today, deposit rates offered by banks are in no position to be revised down unless durable liquidity improves on a sustained basis.

Rate cut without an improvement in durable liquidity will inhibit credit led growth recovery

The current high credit-to-deposit ratio of 80% could limit the banks' ability to transmit rate cuts effectively and may also restrict the availability of credit. As a result, additional measures are necessary to ensure that monetary easing translates into tangible improvements in real economic growth in India.

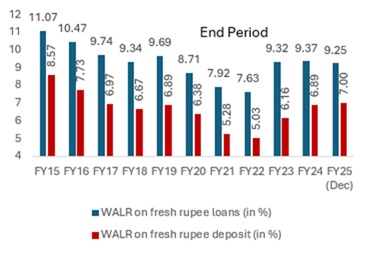

Cost of funds for the banks have been rising for the banks

Impact of Rate Cuts and LCR Guidelines on Banks' Liquidity and Margins

From the banks' perspective, the only relief comes in the form of an extension and guidance for the calibrated implementation of the LCR guidelines. However, during the rate cut cycle, banks may be hesitant to reduce their SLR holdings. As a result, it may take some time for the overall liquidity environment to become more favorable for banks. Initially, there could be margin pressures as loans are repriced faster than deposits.

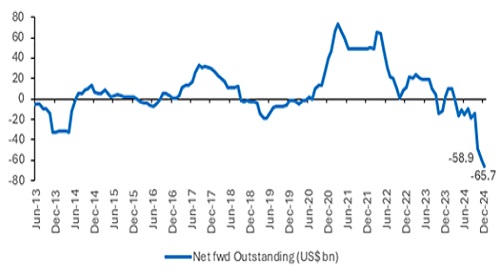

Depreciation bias on rupee maintains

Currency had depreciated ahead of today’s policy and currently hovers around 87.5/US$. While peak pessimism on rupee has likely passed, an elevated sell position in RBI’s forward book (US$ 66bn as of Dec’24) and no material turnaround in FII flows in the near-term keeps us cautious on rupee.

RBI’s net forward outstanding book has risen to a sell of US$66 as on December; puts pressure on currency

Positive outlook on government bonds

From the fixed income perspective, bonds sold off post policy perhaps because expectations were too aggressive ahead of the policy. The continuation of the ‘neutral’ stance and no additional liquidity related announcement might have come as a dampener. That said, overall liquidity outlook still warrants more OMO actions (purchase) by the RBI which lends a material positivity to the overall demand supply dynamics for the government bond. Further, a re-iteration of fiscal prudence in the latest budget, sanguine outlook on inflation and a contained current account deficit (~1% of GDP) works as a long-term macro positive. Recognizing the volatility on dollar and US yields and external risks, we stay positive on fixed income , given the higher carry and spreads.

Above views are of the author and not of the website kindly read disclaimer

More News

Expectations on Upcoming Monetary Policy by Shrinivas Rao, FRICS, CEO, Vestian