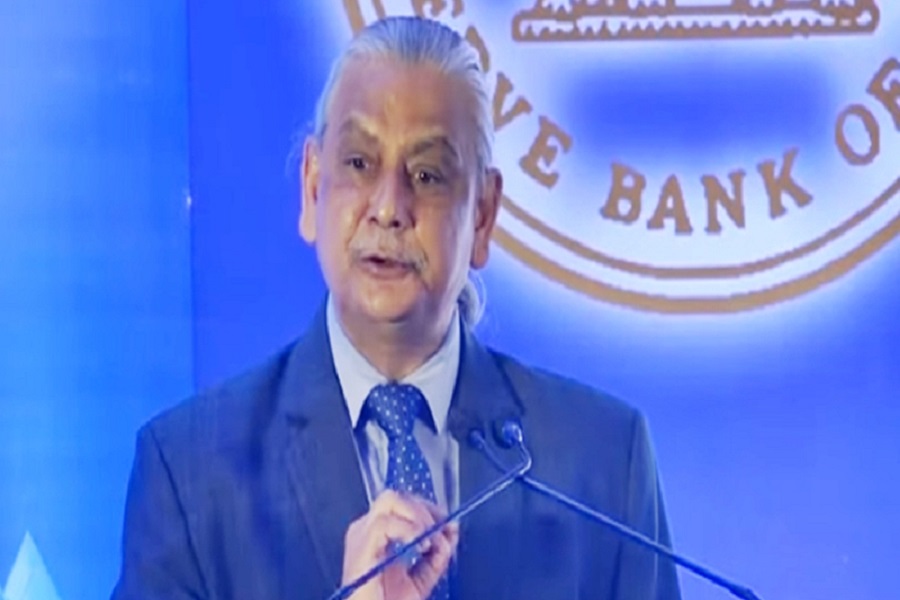

Quote on Closing Market Summary 29th Oct 2025 by Hardik Matalia, Derivative Analyst - Research at Choice Equity Broking Private Limited

Below the Quote on Closing Market Summary 29th Oct 2025 by Hardik Matalia, Derivative Analyst - Research at Choice Equity Broking Private Limited

"On October 29, Indian equity markets ended on a firm note, supported by positive global cues and renewed buying interest in select sectors. The BSE Sensex closed at 84,977.13, gaining around 0.44%, while the Nifty 50 settled at 26,053.90, up about 0.45%.

The session opened higher and maintained a positive tone throughout the day, briefly crossing the 26,050 mark before witnessing mild profit-booking at higher levels. Despite intermittent volatility, both benchmarks managed to hold onto their gains into the close. Broader markets also mirrored the trend, with the Nifty Midcap rising 0.64% and the Nifty Smallcap advancing 0.43%, reflecting a continuation of buying interest across the broader spectrum.

Technically, the Nifty continues to maintain a sideways-to-bullish bias as long as it sustains above the 25,900–26,000 support zone. On the upside, immediate resistance is placed around 26,100–26,200, and a sustained move above this range could open the door for further gains toward 26,300–26,400 in the near term.

Buying interest was prominent in Oil & Gas, Metal, Energy, and Media stocks, with the Oil & Gas index emerging as the top performer, rising over 2%. In contrast, Auto and select IT counters witnessed mild profit-taking after recent strength. Banking stocks traded mixed, while FMCG and PSU names provided additional support to the broader indices.

With the monthly F&O expiry now behind, markets witnessed reduced volatility as traders rolled over positions to the new series. Following expiry-led adjustments, overall sentiment remained constructive, supported by stable global cues and sustained buying in select sectors. Derivative data now indicates fresh support building around 26,000–25,900, while resistance has shifted higher to 26,100–26,200, suggesting a strengthening bullish bias."

Above views are of the author and not of the website kindly read disclaimer

More News

Quote on Pre-Market Comment by Hardik Matalia, Research Analyst, Choice Broking Ltd