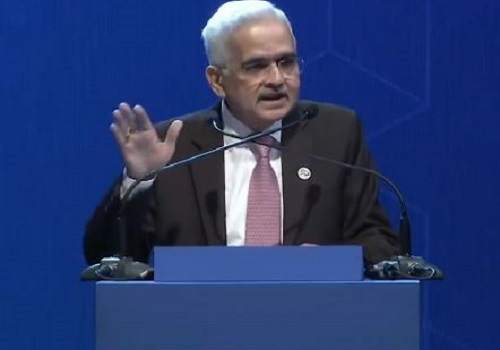

Private sector banks need to catch up on government's financial inclusion drive: Vivek Joshi

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Financial Services Secretary Vivek Joshi has flagged lower participation by private sector banks in the government's financial inclusion drive and nudged them to step up their efforts to popularise such schemes. He also asked banks and financial institutions to work on three areas -- getting KYC done for inoperative accounts, nomination for bank accounts and strengthening cyber security. He noted that the flagship government insurance schemes are Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY) and Atal Pension Yojana (APY). Besides PMJDY, other financial inclusion schemes include the Mudra Yojana and the StandUp India Scheme.

Joshi stated that currently, 92 per cent of the adults in India have at least one bank account, and around 3 crore Jan Dhan accounts are added every year. He said ‘we are not far from a situation where all the adults in the country will be covered with at least one basic bank account.’ In over nine years of the launch of the PM Jan Dhan Yojana (PMJDY), 51 crore bank accounts have been opened.

He said that while private sector banks have increased their credit disbursal under the Mudra scheme, where loans are given to micro businesses, in other financial inclusion schemes, their participation is lacking. He said ‘I would request the private sector banks to increase participation in PMJDY and Jan Suraksha schemes in order to realise the ambitious goals which the government has set for itself.’ He added that financial inclusion does not only mean opening bank accounts but also providing insurance and pension coverage to customers.