Post Market Comment by Mandar Bhojane, Research Analyst, Choice Broking

Below the Quote on Post Market Comment by Mandar Bhojane, Research Analyst, Choice Broking

The Nifty witnessed a volatile trading session today. It opened on a positive note, sustained above the 24,600 level, and closed the day in the green, up approximately 126.2 points. On the daily charts, we observe that the Nifty has been in a recovery phase after testing the lower end of the channel. It has now reached the 24,900 – 25,050 zone, where resistance is present in the form of the 1.618% Fibonacci retracement level.

Nifty faces immediate resistance near the 24,850 and 25,000 levels. On the flip side, 24,550 and 24,500 levels act as immediate support. If the index manages to close above the 24,700 level, it could potentially target the 24,900 and 25,050 levels in the coming days. The overall trend remains sideways to bullish.

The India VIX, which reflects market volatility, decreased by 3.46 percent to close at 13.8200, indicating heightened market volatility. Open Interest (OI) data showed the highest OI on the call side at the 24,900 and 25,000 strike prices, while on the put side, it was concentrated at the 24,500 strike price.

Above views are of the author and not of the website kindly read disclaimer

Tag News

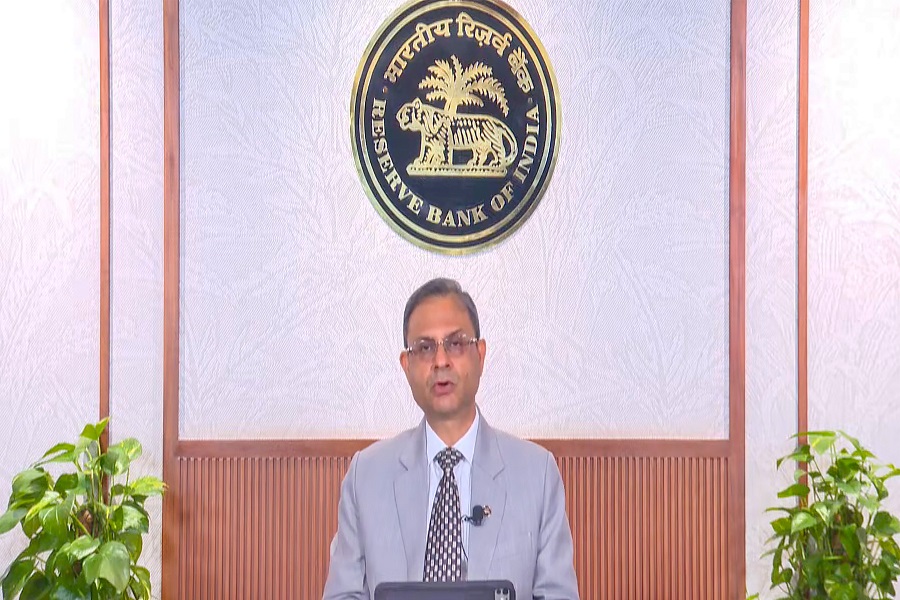

Sensex, Nifty end in green after positive cues from RBI MPC meet

More News

Quote on Market Morning inputs by Shrikant Chouhan, Head Equity Research, Kotak Securities