Openinig Bell : Markets likely to make gap-down start tracking weak global peers

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Asian markets are trading in red in early deals on Thursday on weak cues from the US markets overnight. The US markets ended lower on Wednesday as concerns about the outlook for the U.S. economy continued to hang over the markets.

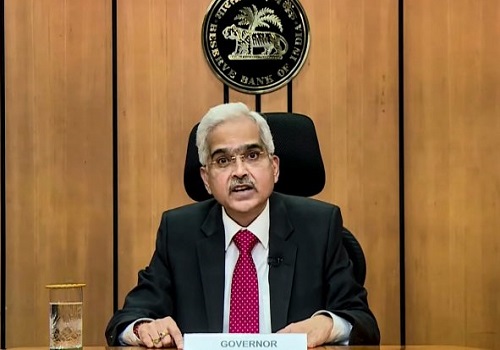

Back home, Indian equity benchmarks bounced back sharply on Wednesday after three straight days of slump following a rally in global peers and value-buying in Oil & Gas, Metal and Energy shares at lower levels. Markets made an optimistic start and stayed in green for whole day as traders took encouragement with a Labour Ministry report showing that retail inflation for industrial workers slipped to 3.67 per cent in June from 3.86 per cent in the previous month this year mainly due to lower prices of certain food items. It said year-on-year inflation for the month of June 2024 moderated to 3.67 per cent as compared to 5.57 per cent in June 2023. Traders took support with S&P Global Ratings’ report stating that India is a well diversified exporter and a blip in its exports to Bangladesh is unlikely to have any meaningful impact on India's overall trade position for the full year. Markets continued to trade higher in late afternoon session, taking support from a private report stating that India's central bank could cut interest rates by 100 basis points in a monetary easing cycle that is likely to start in December as inflation eases towards its 4% target. Some optimism also came as the government has approved the continuation of interest subvention scheme for short-term loans of up to Rs 3 lakh for agriculture and allied activities availed through Kisan Credit Card (KCC) during the current financial year. Under the scheme, farmers get loan at a concessional interest rate of 7 per cent. An additional interest subvention of 3 per cent per annum is provided to farmers who repay loans in time. Meanwhile, Reserve Bank's rate-setting panel started its three-day deliberations for the next set of bi-monthly monetary policy amid expectations of no change in benchmark interest rate in view of concerns on inflation and economic growth remaining steady. The decision of the RBI Governor Shaktikanta Das-headed six-member Monetary Policy Committee (MPC) will be announced on Thursday. Finally, the BSE Sensex rose 874.94 points or 1.11% to 79,468.01, and the CNX Nifty was up by 304.95 points or 1.27% points to 24,297.50.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Technical Outlook for the week starting November 25 by Lovelesh Sharma, Consultant, SAS Onli...

More News

Extending its gain for second straight day, banking index managed to end higher by 150 point...