Opening Bell : Markets likely to start holiday shortened week on cautious note

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

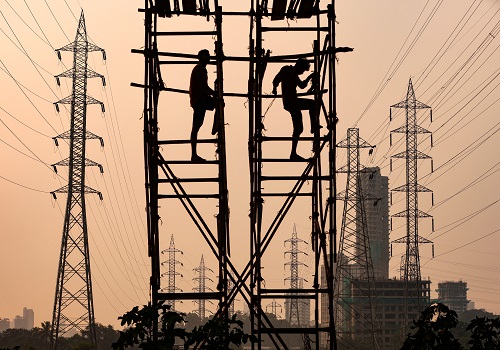

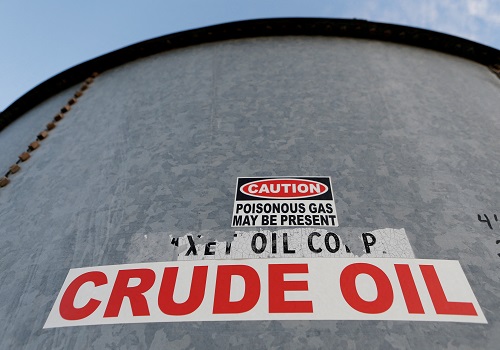

Indian markets retracted from lifetime highs to settle lower on Friday due to profit-taking in frontline stocks HDFC Bank and ICICI Bank. Today, markets are likely to start holiday shortened week on cautious note amid mixed cues from global markets and escalating Middle East tensions due to Israel intensifying attacks on Iranian-backed forces. Some cautiousness will come amid higher oil prices, in early deals, on increasing concerns of potential supply disruptions from the Middle East producing region after Israel stepped up attacks on Iranian-backed forces. Foreign fund outflows likely to dent domestic sentiments. On September 27, 2024, Foreign Institutional Investors (FIIs) sold shares worth Rs 1,209.10 crore. Investors likely to remain on sidelines ahead of key economic indicators from India, including manufacturing, services, composite indices, current account deficit (CAD), external debt, and government budget figures, during this week. However, traders may take note of commerce and industry minister Piyush Goyal’s statement that actual investments under the Production Linked Incentive (PLI) schemes were Rs 1.46 lakh crore till August and expected to increase to Rs 2 lakh crore in the coming years. This has resulted in production/sales worth Rs 12.5 lakh crore and employment generation of around 9.5 lakh (direct & indirect) which is expected to reach 12 lakh soon. Besides, the RBI said India’s forex reserves jumped by $2.838 billion to a new all-time high of $692.296 billion for the week ended September 20. There will be some buzz in OMCs as the Crisil Ratings said India’s oil marketing companies (OMCs) are expected to increase the country’s crude oil refining capacity by 35-40 million tonnes (MT) by the end of fiscal 2030. Metal stocks will be in focus with a private report that the growth trajectory of iron ore continues as production for the current fiscal year 2024-25 (April-August) surged to 116 MMT during the April-August period, up from 108 MMT during the same timeframe last year, marking a healthy increase of 7.4 per cent. There will be some reaction in textile stocks as the Union Minister of Textiles Giriraj Singh said the textiles industry will grow to $350 billion by 2030 generating crores of jobs. He added the 100-day achievements lay the foundation for achieving the set targets by 2030 and focus on all aspects of the value chain of the textiles sector. Banking stocks will be in focus with a private report that Indian banks are expected to see improvements in their loan-to-deposit ratios after a large majority of them reported increases in the April-June quarter. Meanwhile, Manba Finance (Mainline) will be listed on the stock exchanges.

The US markets ended mostly in red on Friday as AI investor favorite Nvidia led a broad selloff for chipmakers, offsetting soft PCE inflation report and data showing strong sentiment among U.S. consumers. Asian markets are trading mixed on Monday as investors anxiously waited for more direction from new Prime Minister Shigeru Ishiba, who has been critical of the Bank of Japan's easy policies in the past.

Back home, Indian equity benchmarks ended lower on Friday as investors turned cautious ahead of the key US inflation data. Markets made a slightly positive start and managed to keep their heads above water in first half of trading session, amid foreign fund inflows. As per NSE data, Foreign Institutional Investors (FII) were net buyers of Indian equities worth Rs 629.96 crore. Traders took support with a finance ministry report stating that India is set to achieve 6.5-7 per cent GDP growth in the current financial year as indicated by the movements in high-frequency indicators till August. Some support came with the finance ministry stating that the Centre has retained its borrowing target for the current financial year and plans to raise Rs 6.61 lakh crore through auction of dated securities during October-March period of 2024-25 to fund the revenue gap to boost economic growth. Traders took a note of former RBI Governor Raghuram Rajan’s statement that India has done well in areas like infrastructure in the last 10 years, but it also needs to do more in other sectors to boost local manufacturing and job creation. Rajan further said the government's focus on production, whether it is goods or services is a good thing, but it is also important to do it the right way. However, markets erased gains and slipped into red terrain in early afternoon deals as traders got cautious with a private report stating that India’s urban-rural income gap has increased over the last seven years, as urban incomes have outpaced rural areas for both salaried and self-employed people. Markets ended lower as traders resorted to profit taking in banking, realty and utilities stocks. Investors overlooked the report that India's ranking in the Global Innovation Index has improved, climbing one place to 39th rank out of 133 economies in the Global Innovation Index (GII) 2024. Last year, the country was ranked 40th. The consistent improvement in the GII ranking is owing to the knowledge capital, vibrant start-up ecosystem, and the amazing work done by the public and private research organisations. Finally, the BSE Sensex fell 264.27 points or 0.31% to 85,571.85, and the CNX Nifty was down by 37.10 points or 0.14% to 26,178.95.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Benchmark index is likely to trade with mild positive bias today - Monarch Networth Capital Ltd