Number of M&A deals in Consumer space highest in the last 4 years: Equirus Capital

The number of deals in the 9MCY25 (Jan-Sept) stood at 115 which is a 4-year high as per a press note released by Equirus Capital – Mumbai based full-service investment banking. The press note details the M&A developments in the consumer sector.

The number of deals in the first 9-months, from January till September stands at 115, which is a 4-year high. The previous high noted in CY22 was 100 deals. Food & Beverage segment and Apparel & Accessories witnessed the highest percentage of deals in Jan-Sept '25, with 41% and 24% respectively.

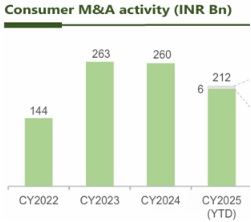

With regard to the quantum of fund raising in CY25 (YTD), the consumer segment witnessed deals worth more than Rs 21,200 crores, with 74% of the deals in Food & Beverage segment. There were 10 M&A Deals in Sept 2025, Trident Group’ deal accounted was the largest with ~ INR 2,486 Mn. The month also saw Marico acquiring a 46% stake in HW Wellness Solutions for INR 1,385 Mn.

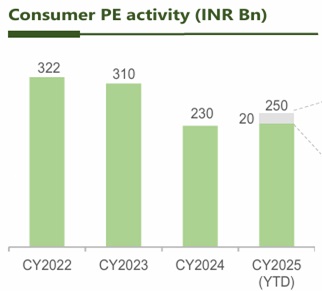

As many as 237 PE deals were closed January-September (CY2025 YTD), in the last month, there were 7 VC deals and 15 PE deals. The PE deals accounted for ~ 99% of total deal value in September 2025.

In terms of value, the PE deals were worth more than Rs 25,000 crore, with F&B segment accounted for 49% of the deals. The average deal size in September 2025 was ~INR 1,070 Mn. The KPN Fresh Farm deal accounted for a significant portion ~31% of total PE deal value in September 2025.

Above views are of the author and not of the website kindly read disclaimer