Non-Life Premiums Off to a Modest Start in FY26

Overview

In April 2025, the non-life insurance industry reported a premium of Rs 33,688.5 crore, representing a 13.5% growth compared to the 15.9% growth reported in April 2024. The industry’s transition to the 1/n rule, slowing health, and subdued PV growth have affected the industry’s performance.

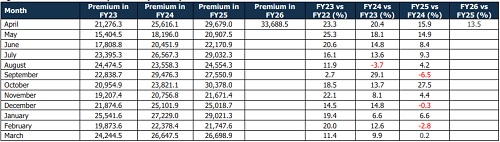

Figure 1: Movement in Monthly Premium (Rs crore)

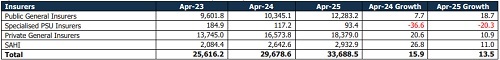

Figure 2: Movement in Gross Direct Premium Underwritten (Rs crore)

• Public sector general insurers' growth for April 2025 outpaced their private counterparts. The growth can primarily be attributed to renewals in fire and engineering, along with Health and Motor TP, while the transition to the 1/n rule has slowed the headline growth. The private non-life insurance companies continue to maintain over two-thirds of the market share. • The monthly growth figures for specialised insurers fell by 20.3% in April 2025, following a decline of 36.6% in April 2024. The segment appears to be normalising at a lower level, as crop insurance premiums have shifted from the Agriculture Insurance Co. of India Ltd. to general insurers, while the ECGC reported modest growth. • Standalone Private Health Insurers (SAHI) saw their year-on-year (y-o-y) growth momentum slow to 11.0% in April 2025, which was less than half the rate reported last April. SAHIs continue to gain share, at the expense of private general insurers.

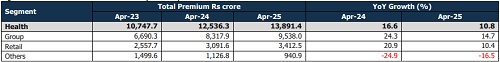

Figure 3: Movement in Health Premiums (Rs crore)

• Health insurance premiums continue to be the largest segment of the non-life insurance industry. The aggregate growth has been slowing as the base effect is kicking in after the post-pandemic growth. SAHIS have consistently outperformed growth in the healthcare segment. The public sector health insurance business has continued to lag its private peers.

o The Group Health segment remains the largest and fastest-growing segment in April, driven by renewals and price escalations resulting from medical inflation and favourable claims experience. o The Retail segment experienced a halving of growth in April 2025 compared to April 2024, with the 1/n rule likely contributing to the slowdown. The slowdown may also be attributed to factors such as the post-COVID boom losing momentum, and rising medical inflation, which has made premiums expensive, impacting affordability. o SAHI have focused on retail, while general insurers accounted for a dominant share of the group business. Furthermore, with new SAHIs on the horizon, competition is likely to intensify in the medium term.

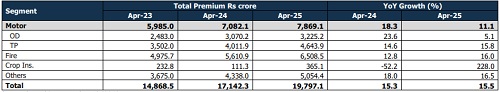

Figure 4: Movement in Non-Life Premiums excluding Health Premiums (Rs crore)

• If we observe the growth of the non-life insurance industry excluding health, it stood at 15.5% on April 25, compared to the 13.5% level if health is included in the analysis. Furthermore, a sizable proportion of this 15.5% growth was attributed to the motor and fire segments, which accounted for over 70% of the non-life insurance excluding health. o Motor OD grew by 5.1% (vs. 23.6% for April 24) and motor TP rose by 15.8% (vs. 14.6% for April 24). Passenger vehicle domestic sales and competition have contributed to lukewarm motor OD growth, whereas the motor TP segment has grown at a healthy rate despite flat TP tariffs. o Fire and engineering premiums grew by 16.0% and 17.1%, respectively, in April 2025 compared to an increase of 12.8% and a decrease of 14.8%, last April, as corporations renew their policies in the first quarter of the fiscal year. The PA segment grew by nearly 48% in April 2025, compared to a 20% rise last year, primarily due to renewals. Meanwhile, crop insurance growth normalised when compared against the April 2023 numbers.

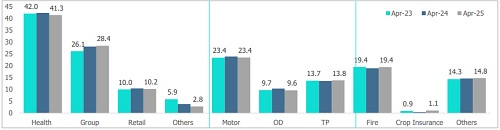

Figure 5: Movement in Segment Market Share by Premiums (In %)

CareEdge Ratings View “In April 2025, the non-life insurance industry reported a premium of Rs 33,688.5 crore, representing a 13.5% growth compared to the 15.9% growth reported in April 2024. The industry’s transition to the 1/n rule, slowing health, and subdued PV growth have affected the industry’s performance with renewals in the fire and engineering segment contributing to growth,” said Saurabh Bhalerao, Associate Director of CareEdge Ratings. FY25 marked a significant achievement for India's non-life insurance industry as it crossed the Rs 3 lakh crore premium threshold. A favourable regulatory environment, investment in Insurtech, digitisation, and an expanding middle class, combined with the Bima Trinity, would support overall growth. Meanwhile, SAHIs are expected to continue dominating the retail health insurance space. Furthermore, growth in the motor segment remains contingent upon momentum in vehicle sales and the revision of TP tariffs. The expected regulation on composite licences is anticipated to be a game changer, increasing competition in the medium term. However, intensified competition and uncertainties in the international geopolitical environment could impact the non-life insurance sector,” concluded Priyesh Ruparelia, Director of CareEdge Ratings.

Above views are of the author and not of the website kindly read disclaimer