Most Asian shares track Wall Street higher, oil extends losses

Asian stocks were mostly higher on Tuesday, supported by a strong Wall Street close and investor optimism about corporate earnings, while the dollar held near a two-month top, aided by bets on a smaller U.S. rate cut next month.

Oil prices are down about 3% after Israeli Prime Minister Benjamin Netanyahu reportedly told the United States that Israel is willing to strike Iranian military targets and not nuclear or oil ones, easing immediate concerns about supply disruptions. [O/R]

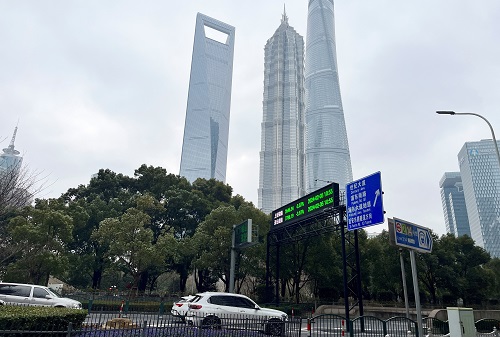

The Nikkei rallied 1% to a three-week peak, having been closed on Monday for a holiday. MSCI's broadest index of Asia-Pacific shares outside Japan edged up 0.2% as gains in Taiwan and Australia were partly offset by a drop in Chinese markets.

China's blue chips fell 0.4%, while Hong Kong's Hang Seng index slipped 0.3% as a lack of new stimulus details from Beijing left investors wanting for more.

Local media reported that Beijing may raise an additional 6 trillion yuan ($850 billion) from Treasury bonds over three years to help bolster a sagging economy.

"China's signal on policy stimulus prompted us to go modestly overweight, especially given depressed valuations. Details have been scant, so we could change our view if future announcements disappoint," said analysts at BlackRock Investment Institute.

"We still like U.S. stocks and the broad AI theme as corporate earnings growth expands beyond tech. Yet fears over stretched valuations can drive brief selloffs. This calls for considering global exposure where we see cheap valuations and potential catalysts."

Overnight, the S&P 500 and Dow roared to record high closes, led by chip stocks after a 2.4% jump in AI darling Nvidia and a brisk start to the third-quarter earnings season with beats by JP Morgan and Wells Fargo.

Other big banks including Citi, Bank of America and Goldman Sachs will report quarterly results on Tuesday.

In the foreign exchange market, the dollar slipped 0.2% to 149.50 yen, pulling back from a 2-1/2-month high of 149.98 overnight. The euro held at $1.0906, up off the 10-week trough overnight, ahead of a rate decision from the European Central Bank on Thursday.

The dollar has been buoyed by conviction the Federal Reserve will choose a smaller 25 basis point rate cut next month, rather than a 50 bp move, given the economy continues to grow without overheating.

Fed Governor Christopher Waller on Monday called for "more caution" on interest-rate cuts ahead, while Fed Minneapolis President Neel Kashkari sees more modest rate cuts ahead.

Traders are pricing in about an 88% probability the Fed will cut rates by 25 basis points next month and a 12% chance it would leave rates unchanged, according to CME's FedWatch.

The U.S. bond market was shut for a holiday on Monday, but cash Treasuries fell slightly in early Asia trade. Two-year Treasury yields are up 1 basis point to 3.9533%, while 10-year yields climbed 2 bps to 4.0885%.

Oil extended its declines for a third straight session on demand concerns and as the jitters about Israel's attack on Iran calmed. Brent futures fell 2.9% to $75.22 a barrel, having dropped 2% overnight.

Gold was 0.1% lower at $2,648.57 an ounce.