2025-03-03 09:52:40 am | Source: Geojit Financial Services Ltd

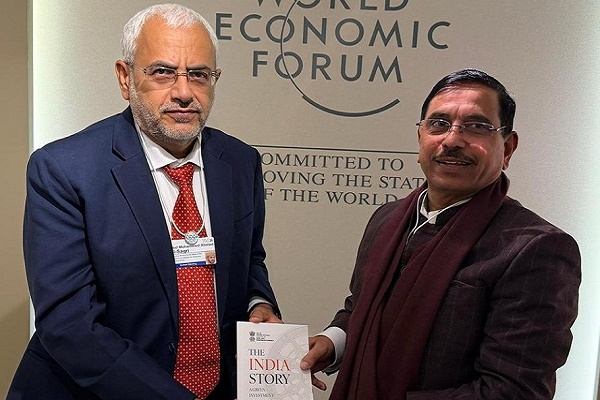

Morning Market Quote : The main triggers for the sustained FII selling in India have been the high valuations and the attractive US bond yields Says Dr. V K Vijayakumar, Chief Investment Strategist, Geojit Financial Services

Below the Quote on Market by Dr. V K Vijayakumar, Chief Investment Strategist, Geojit Financial Services

"The main triggers for the sustained FII selling in India have been the high valuations and the attractive US bond yields. These important macros are undergoing a slow shift. Largecap valuations are now fair and in segments like financials attractive. US 10-year bond yields have declined to 4.21%. So, there is a possibility of FIIs reducing their selling, going forward. There is good news on India’s growth front. The Q3 GDP growth numbers picking up from 5.6% in Q2 to 6.2% in Q3 and suggesting above 7 % growth in Q4 is indicative of cyclical recovery which bodes well for the stock market.

The correction in the market is an opportunity for long-term investors to buy high quality stocks. The February auto sales numbers reveal excellent performance from M&M and Eicher. IT stocks also are turning attractive.

It is difficult to predict when the market will bottom out. But this is the time to start buying without bothering about the near-term volatility."

Above views are of the author and not of the website kindly read disclaimer

Disclaimer:

The content of this article is for informational purposes only and should not be considered financial or

investment advice. Investments in financial markets are subject to market risks, and past performance is

not indicative of future results. Readers are strongly advised to consult a licensed financial expert or

advisor for tailored advice before making any investment decisions. The data and information presented

in this article may not be accurate, comprehensive, or up-to-date. Readers should not rely solely on the

content of this article for any current or future financial references.

To Read Complete Disclaimer

Click Here