MCX Natural gas April is expected to trade lower towards Rs.282 level as long as it trades under Rs.312 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Gold is expected to take a breather and move lower amid easing trade war concerns. Profit booking and improved risk sentiments would bring correction in price towards $3180 per ounce. The broader trend still remains positive amid trade war uncertainty and increasing inflows in to the bullions. Further, weakness in the dollar and escalating trade tension between US and China would bring more investment into the bullions.

* On the data front a higher call base at 3250 strike would act as key hurdle for prices. Meanwhile, immediate support holds near $3150. MCX Gold June is expected to move towards Rs.92,500,a s long as it trades under Rs.93,800 level.

* MCX Silver May is expected to extend its rebound toward ?96,200, as long as it trades above Rs.93,000 level. A drop in gold silver ratio below 100 indicates an improved risk on trade. Meanwhile, investors will eye key economic numbers from US and Fed members comments to get further clarity on direction.

Base Metal Outlook

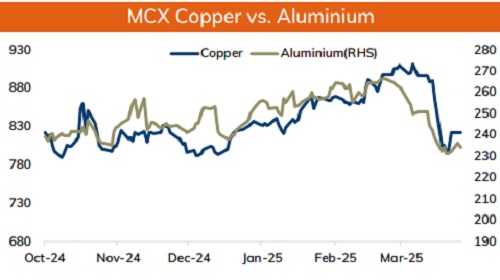

* Copper prices are likely to extend its rebound amid improved risk sentiments. The pause on tariffs on consumer electronics would provide some support to metal price. Further, weakness in the dollar and improved demand from China would help the metal to hold firm. Furthermore, lower prices and superior import parity would attract more buyers. Meanwhile, investors are keeping a close eye on upcoming trade talks between the US and key partners this week to get further clarity.

* MCX Copper April is expected to hold support of 200 day EMA at Rs.837 and move higher towards Rs.855. A move above Rs.855 price may extend its rally towards Rs.860.

* MCX Aluminum April is likely to consolidate in the band of Rs.230 and Rs.237 level. Only above Rs.237 level, it would rise towards Rs.240. MCX Zinc April is likely to face the hurdle near Rs.256 and move in the band of Rs.248 to Rs.256level.

Energy Outlook

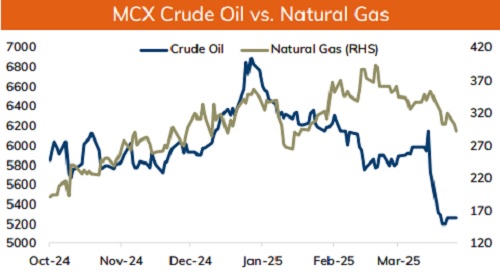

* NYMEX Crude oil is expected to hold its ground and move back towards $64 per barrel amid improved risk sentiments as the US President hinted at another tariff exemption. But gains could be capped amid increasing bets of supply improvement from OPEC+ nations. Hopes of deal between US and Iran also raised prospects of increased oil export from Iran. Meanwhile, downward revision to demand growth for 2025 by OPEC and EIA would restrict any major up move in price. EIA has lowered its growth forecast by 30% to 900kb/d.

* On the data front, addition of OI in OTM and ATM call strike indicates price to face stiff resistance near $65 per barrel. On the downside, a strong put base at 60 strike would act as key support. MCX Crude oil April is likely to consolidate in the band of Rs.5100 and Rs.5400 level. A move above Rs.5400 would open the doors towards Rs.5580.

* MCX Natural gas April is expected to trade lower towards Rs.282 level as long as it trades under Rs.312 level. Above normal temperature in US would hurt demand outlook.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

.jpg)

.jpg)