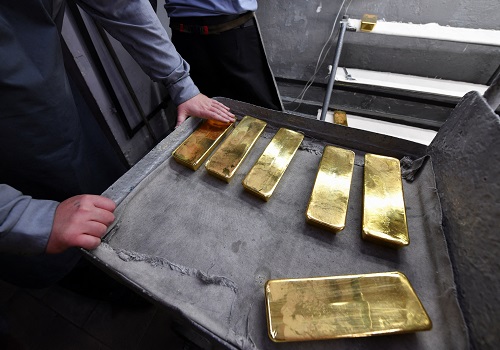

MCX Gold prices is likely to move south towards 57,000 level as long as it trades below the resistance level of 57,600 levels - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Metal’s Outlook

Bullion Outlook

• Spot gold is likely to slip further towards $1810 levels as long as its stays below $1840 levels amid strong dollar and surge in US treasury yields. Yields are rising as improved economic data from US bolstered hopes that US Fed will keep rates higher for longer. Additionally, last minute deal that averted a government shutdown will reduce demand for US debt. Moreover, market will remain cautious ahead of US jolts job opening data

• MCX Gold prices is likely to move south towards 57,000 level as long as it trades below the resistance level of 57,600 levels

• MCX Silver is expected to follow gold prices and move lower towards 68,500 level as long as it sustains below 69,500 level

Base Metal Outlook

• Copper prices are expected to trade with negative bias amid strong dollar and weak global market sentiments. Market sentiments are hurt as investors fear that interest rates in key economies would stay higher for longer than previously estimated. Additionally, several policymakers signaled that monetary policy will need to stay restrictive for some time to bring inflation back down to its 2% target

• MCX Copper may slip further towards 707 levels as long as it trades below 720 levels

• MCX aluminium is expected to move downward towards 207 level as long as it stays below 210.50 level

Energy Outlook

• NYMEX Crude oil is expected to slip further towards $86.50 levels amid strong dollar and pessimistic global market sentiments. Additionally, investors fear that higher borrowing cost for longer duration will crumble global economic growth and dent fuel demand. In Europe, manufacturing data showed activity remained mired in downturn in September. Furthermore, more crude oil supply is likely to come in system as Turkey’s energy minister said the country will restart operations this week on a pipeline from Iraq

• MCX Crude oil is likely to slip towards 7330 levels as long as it stays below 7550 levels

• MCX Natural gas is expected to move downwards towards 220 level as long as it stays below 240 level