LT Foods Delivers Stellar Performance in H1 FY`26 with Revenue surging 25% YOY to Rs. 5,273 Crores and EBITDA growing 20% YoY to Rs. 619 Crores

LT Foods, a global FMCG company in the consumer food space, reported its unaudited consolidated financial results for the second quarter and half year ended September 30, 2025.

Mr. Ashwani Arora, Managing Director & CEO, LT Foods, said, “I am pleased to share that we have concluded the first half of FY’26 on a strong and positive trajectory. Our resilient business model, unwavering commitment to quality, and deep consumer insights have collectively enabled us to deliver a robust 25% growth in revenue, underscoring the strength and agility of LT Foods.

Our Basmati and Other Specialty Rice business recorded a 24% (Normalised growth is 11.4%, excluding Golden Star and U.S. Tariffs) YOY growth in H1 FY’26, driven by enhanced brand investments and focused marketing initiatives that continue to strengthen consumer trust. Our Organic segment delivered a robust 26% year-on-year growth in H1 FY’26, reflecting the rising global demand for sustainable food choices and our strong presence across key international markets.

In India, the market share of our flagship brand DAAWAT stands at 26.1% (MAT September’25; AC Nielsen Retail Survey Audit), reaffirming DAAWAT’s position as the most trusted and preferred brand among consumers. We continue to enjoy a leadership position in the majority of E-Commerce and Q-Commerce platforms, leveraging digital-first strategies to reach new-age consumers and drive category growth. We also expanded our Meal Kit portfolio, with the launch of DAAWAT® Thai Green Curry Rice Kit, a strategic move focused on building a stronger Ready-To-Cook (RTC) and Ready-To-Eat (RTE) portfolio.

In the U.S., our flagship brand Royal now holds over 54% market share in the region, and with the full acquisition of Golden Star, we now proudly lead as the #1 Jasmine rice brand.

Europe + U.K. reported 31% YOY growth, driven by expanding market reach and rising demand for our differentiated offerings. Besides, we have made investments on people and infrastructure in the European Union (E.U). Our recent acquisition of Global Green Kft.for €25 million marks our entry in the canned food business. This acquisition is in line with the long-term strategy of the company for growth through packaged food and to further strengthen its RTH and RTE segment. This will allow us to make further inroads in Central and Southern Europe while adding synergies with its cross distribution network.

As we look ahead in FY’26, our priority is to build a stronger, future-ready LT Foods — one that deepens brand equity, accelerates market expansion, invests in digital transformation, and evolves through strategic partnerships. We remain steadfast in delivering products that embody trust, quality, and value for our consumers across the globe.”

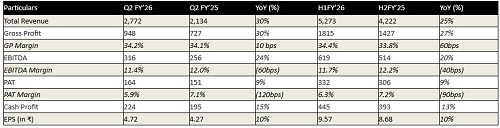

Key Financial Highlights for Q2 FY’26

* Total revenue stood at Rs. 2,772, crores; up 30% YoY

* Gross Profit stood at Rs. 948 crores; up 30% YoY

* EBITDA stood at Rs. 316 crores; up 24% YoY

* Profit After Tax stood at Rs. 164 crores, up 9% YoY

* Cash Profit stood at Rs. 224 crores; up 15% YoY

Key Financial Highlights for H1 FY’26

* Total Revenue stood at Rs. 5,273 , crores; up 25% YoY

* Gross Profit stood at Rs. 1,815 crores; up 27% YoY

* EBITDA stood at Rs. 619 crores; up 20% YoY

* Profit After Tax stood at Rs. 332 crores, up 9% YoY

* Cash Profit stood at Rs. 445 crores; up 13% YoY

The Key Consolidated Financial Parameters: (Rs. in Crore)

* Revenue and Profit: H1FY’26 Revenue and EBIDTA were up by 25% and 20%, respectively on a YoY basis. This robust performance is attributed to strategic brand investments, sustained growth across multiple segments and geographies, increasing consumer demand and preference for our brands, and improved distribution channels across key markets.

* Basmati and Other Specialty rice business for H1 FY’26 grew by 24% (Normalized growth is 11.4%, excluding Golden Star and U.S. Tariffs) on a YoY basis on account of increased investment in brand and marketing.

* Organic segment for H1FY’26 grew by 26% on a YoY basis.

* Revenue in the RTH & RTC comprising of DAAWAT® Quick Cooking Brown Rice, DAAWAT® Quick Cooking Black Rice, DAAWAT® Quick Cooking Red Rice on the Health platform and Royal Ready-to-Heat (in the US), DAAWAT® Cuppa Rice, DAAWAT® Biryani Kit and Kari Kari (Japanese Rice Snacks) in H1 FY’26 stood at Rs. 95 crores.

* Margin Profile:

* Gross Profit for H1FY’26 increased by 27% on a YoY basis to Rs. 1,815 crores and the Gross

* Profit Margin increased by 60 bps to 34.4%.

* EBITDA increased by 20% on a YoY basis to Rs. 619 crores and the EBITDA Margin decreased marginally by 40 bps to 11.7% in H1FY’26.

* PAT increased by 9% on a YoY basis to Rs. 332 crores and the PAT Margin decreased by 90 bps to 6.3% in H1FY’26.

* Further Strengthening Financial Metrics:

* Current Ratio at 2.0 in H1FY’26 compared to 2.5 in H1FY’25

* Interest Coverage Ratio at 9 in H1FY’26 compared to 11.1 in H1FY’25

* Net Debt-Equity at 0.14 in H1FY’26 compared to 0.22 in H1FY’25

* Net Debt-EBIDTA at 0.46 in H1FY’26 compared to 0.79 in H1FY’25

* RoCE at 22% in H1FY’26 compared to 20.8% in H1FY’25

* RoE at 16.5% in H1FY’26 compared to 17.1% in H1FY’25

Above views are of the author and not of the website kindly read disclaimer