Loan book of India`s SFBs to grow by 25-27% in FY25: Crisil

Crisil Ratings in its latest report has said that small finance banks (SFBs) are expected to grow their loan book by a robust 25-27 per cent this fiscal year (FY25). However, it said the growth in loan books will be slightly lower than the previous fiscal growth of 28 per cent.

It stated growth will be sustained by segmental and geographic expansion supported by a robust and growing presence in semi-urban and rural markets with significant unmet demand. It said, noting the difficulty of mobilizing deposits, SFBs will probably look into non-deposit alternatives in order to finance credit expansion. The SFBs continue to have healthy capital buffers to sustain growth.

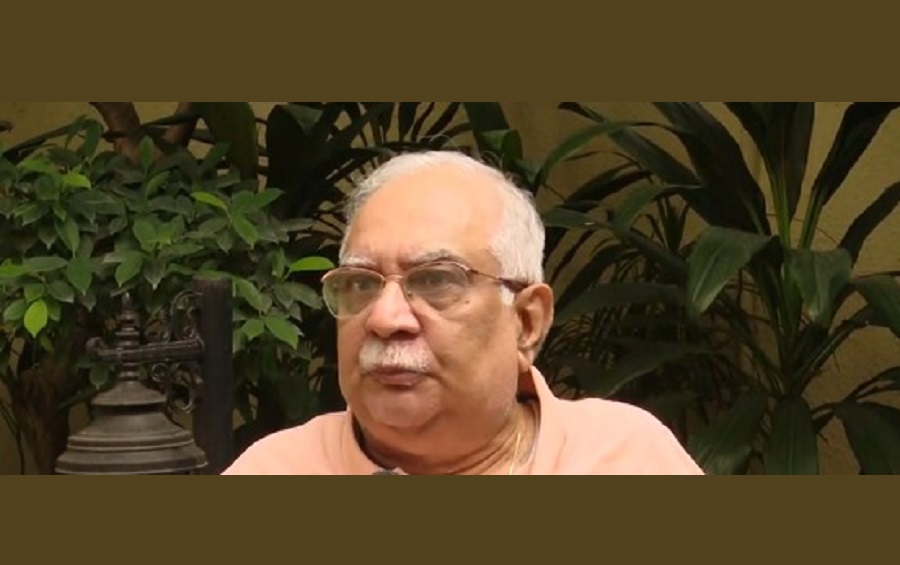

Ajit Velonie, Senior Director, of CRISIL Ratings, said ‘Credit growth in new asset classes is seen at 40 per cent this fiscal, while that in traditional segments will be 20 per cent. With this, the portfolio mix will continue to shift; the share of new segments will cross 40 per cent by March 2025, twice the March 2020 level. Most of this diversification is towards secured asset classes, resulting in the share of secured lending rising, albeit at a moderate pace.’