IPO Note : Canara HSBC Life Insurance Company Ltd by Geojit Financial Services Ltd

Trusted lineage with valuation comfort

Canara HSBC Life Insurance Company Ltd. (CHLICL), founded in 2007, is a private life insurer jointly promoted by Canara Bank, India’s fourth-largest public sector bank, and HSBC Insurance (Asia-Pacific) Holdings Ltd., part of the global HSBC Group. As of June 2025, it ranks among the top three public sector bank–promoted life insurers in India, covering over 1.05 crore lives.

* India’s total life insurance premium is expected to grow at a CAGR of 8–10% during FY26–28, while bank-led insurers are projected to expand at a faster pace of 10–12% CAGR over the same period.

* Initiatives such as IRDAI’s Insurance for All by 2047, government-led financial inclusion schemes like the Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), and GST exemptions on individual life and health insurance policies are expected to drive demand growth.

* CHLICL’s AUM rose to Rs.43,639.4cr in Q1FY26 from Rs.30,204.4cr in FY23, reflecting robust fund inflows and business growth at a CAGR of 12%.

* The embedded value grew from Rs.4,272cr in FY23 to Rs.6,352cr in Q1FY26 at a CAGR of 13% showcasing higher future profitability.

* The Value of New Business (VNB) rose from Rs.377.6cr in FY24 to Rs.446cr in FY25, growing at 18%, reflecting strong business expansion; however, the VNB margin of 19% remains below peers.

* The annualised premium equivalent (APE) increased from Rs.1,883.7cr in FY23 to Rs.2,339.4cr in FY25, registering a CAGR of 11.4%, driven by growth in regular premium collections.

* Net premium earned grew to Rs.7,850cr in FY25 from Rs.7,030cr in FY23, registering a CAGR of 5.7%, driven by an expanding insured base.

* PAT grew from Rs.91.2cr in FY23 to Rs.117cr in FY25 at a CAGR of 13.2%, showing improved efficiency and consistent income from investments.

* At the upper price band of Rs.106, Canara HSBC trades at a P/EVPS of 1.65x (FY25), representing a ~68% discount to the average valuation of major bankled life insurers. It is demonstrating strong growth in AUM, embedded value and profitability, supported by favorable industry trends and rising awareness. We therefore assign a Subscribe rating with a medium- to long-term investment horizon.

Purpose of IPO

To carry out the Offer for Sale of up to 237,500,000 equity shares by the selling shareholders aggregating up to Rs.2,518cr and achieve the benefits of listing the equity shares on the stock exchanges

Key Risks

* Heavily depended on the bancassurance channel for new business premium, with Canara Bank contributing ~70%.

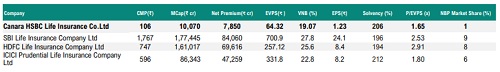

Peer Valuation

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345