Indian Mutual Fund industry’s AUM touches Rs 75.61 lakh cr, up 12.7% YoY: Franklin Templeton India MF

Franklin Templeton India Mutual Fund has released a press note on the development in the Indian mutual funds industry. As per the press note, the Indian Mutual Fund industry’s AUM by the end of September touched Rs 75.61 lakh crore, up 12.7% YoY. Equity oriented funds' AUM at Rs 55 lakh crore, up 9.5% YoY. Fixed Income oriented AUM at Rs 20.61 lakh cr, up 22.2% YoY, Passive Funds AUM at Rs 12.65 lakh cr, up 12.9% YoY. The average SIP ticket size crossed Rs 3000 in Sept '25, at 3018. The equity net sales have been positive for 55 Months (Over 4 Years) now.

Indian Mutual Fund industry’s AUM at all-time

The Indian mutual fund industry had hit an all-time high, of Rs 75.61 lakh crore. The AUM has grown 12.7% in the past 1 year. Equity oriented AUM has touched Rs 55 lakh crore, up 9.5% YoY. Fixed income AUM saw the highest growth of 22.2% at 20.61 lakh crore. Passive funds AUM saw 12.9% growth touch levels of rs 12.65 lakh crore.

SIP flows at an all-time high

The SIP Flows are at an all-time high of Rs 29,361 crore in September 2025. It has doubled in less than 3 years. Monthly SIP flows are up 20% YoY, it has risen to Rs 29,361 crore in Sep’25 vs Rs 24,509 crore in Sep’24. SIP accounts rose to 9.73 crore in Sep’25, down 1.5% YoY. Average SIP size was up at Rs 3018 per month vs Rs 2482 per month last year.

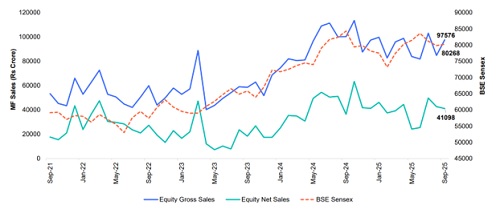

Equity Net Sales Positive for 55 Months (Over 4 Years) despite market correction

The net sales have been positive for over 4 years, 55 months now. The net sales recorded for the month of September 2025 has been at Rs 41,098 crore.

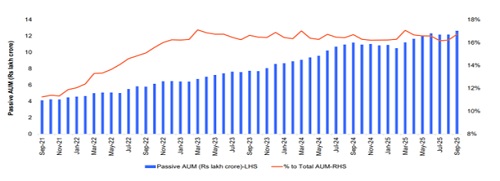

Passive Funds

Passive Funds’ AUM touched Rs 12.65 lakh crore in September 2025 from Rs 11.20 lakh crore a year ago (13% growth). The share of passive AUM rose from 11% of total AUM in September’21 to 17% in September’25.

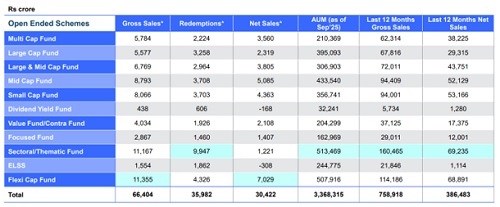

Sectoral/Thematic funds

The Sectoral/Thematic Funds category witnessed the Highest gross/net sales over the last 12 months. The segment witnessed inflows to the tune of Rs 69,235 crores. Most equity categories witnessed positive net sales in September 2025. Mid and small cap continue to attract AUM higher than the largecap funds. Mid cap saw inflows worth Rs 5085 crore, smallcap at Rs 4363 crores, whereas largecap funds witnessed inflows Rs 2319 crores. Debt Categories Witnessed Negative Net Flows of Rs 101,977 crores in September 2025 Due to Quarter End. Arbitrage Funds Received Highest Gross/ Net Sales Over Last 12 Months at Rs 143,787 crores.

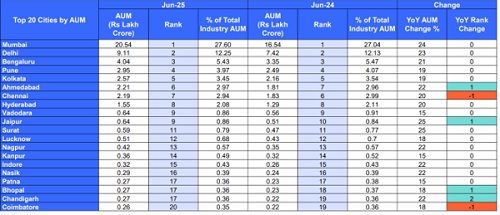

MF AUM from the top 20 cities

The top 20 cities’ contribution to Industry AUM increased in June ‘25 (YoY). Mumbai, Delhi, Bengaluru, Pune, Kolkata, Chennai and Ahmedabad were the top 7 cities respectively contributing to AUM. Ahmedabad, Jaipur, Bhopal and Chandigarh improved in AUM Ranks.

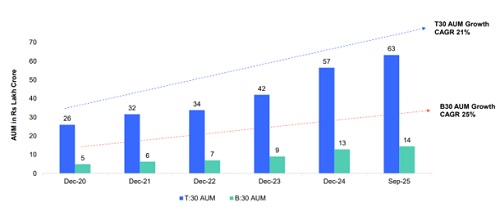

B30 AUM Growth Outpaced T30 AUM Growth

The share of B30 AUM in the industry AUM increased from 16% in Dec 2020 to 19% in Sep 2025.

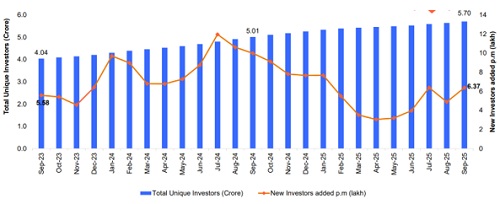

Investor count at an all-time high in September 2025

The total investor count rose to 5.70 crore in September 2025. 6.37 lakh investors were added in September 2025. 69 lakh new investors were added in the last 12 months vs 97 lakh in the same period last year.

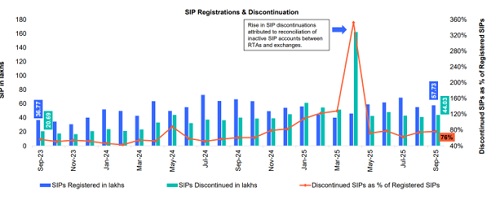

New SIP registration

The New SIP Registrations in September stood at 57.73 Lakhs. SIP discontinuations as % of registered SIPs down to 76% in September 2025.

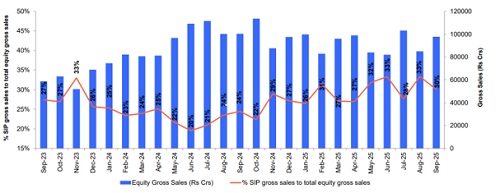

SIP vs Equity gross sales

The SIP Flows as % of Equity Gross Sales is Rising Since June 2024. From around 20% in June 2024, it has now touched 30% in September 2025.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Fund Folio : Equity AUM rises for the 12th successive year; net inflows moderate in CY25 by ...