Indian markets fell for the second day amid weak global cues and FII outflows - Nirmal Bang Ltd

Market Review:

Indian Markets ended lower for the second straight session, as weak global cues and persistent foreign fund outflows weighed on sentiment. The Nifty closed below the 25,150 mark, with PSU banks and consumer durables leading the decline. The S&P BSE Sensex declined 297.07 points or 0.36% to 82,029.98. The Nifty 50 index fell 81.85 points or 0.32% to 25,145.50.

Nifty Technical Outlook

Nifty is expected to open on a positive note and likely to witness positive move during the day. On technical grounds, Nifty has an immediate Resistance at 25280. If Nifty closes above that, further upside can be expected towards 25400-25470 mark. On the flip side 25030-24920 will act as strong support levels.

Action: Nifty has an immediate Resistance at 25280 and on a decisive close above expect a rise to 25400-25470 levels

Bank Nifty

Bank Nifty’s next immediate resistance is around 56950 levels on the upside and on a decisive close above expect a rise to 57180-57340. There is an immediate support at 56470-56230 levels.

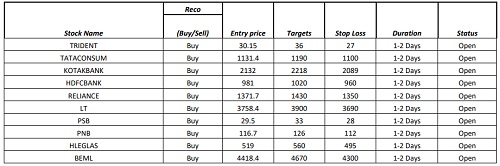

Technical Call Updates

Please refer disclaimer at https://www.nirmalbang.com/disclaimer.aspx

SEBI Registration number is INH00000176