Indian Equities Hit Record Highs as Inflation Tumbles and Valuations Reset: PL Asset Management

PL Asset Management, the asset management division of PL Capital Group (Prabhudas Lilladher), in their recent report ‘PMS Strategy Updates and Insights’, cited that Indian equity markets scaled fresh all-time highs in November, decisively outperforming global peers as a powerful combination of record-low inflation, resilient domestic growth and normalized valuations improved the risk-reward profile for investors. While global markets remained uneven — pressured by weakness in technology stocks, a cooling AI-led rally and soft macro data from China — India stood out as a relative bright spot, supported by strong domestic fundamentals and steady liquidity conditions.

Headline inflation emerged as a key driver of sentiment during the month. Consumer Price Index (CPI) inflation fell sharply to 0.25%, the lowest level on record and well below the Reserve Bank of India’s medium-term target of 4%. The sharp disinflation reinforced expectations of additional policy easing, providing meaningful support to equity valuations. Reflecting confidence in the domestic growth outlook, the RBI revised its FY26 GDP growth forecast upwards to 7.3%, while India posted 8.2% GDP growth in Q2FY26, reaffirming its status as the fastest-growing major economy globally.

Domestic activity indicators remained supportive despite global headwinds. Manufacturing PMI moderated to 56.6 amid tariff-related export softness but continued to signal healthy expansion. GST collections remained robust at ?1.70 lakh crore, underlining the strength of domestic demand, while strong festive consumption further cushioned growth. Importantly, India’s current account deficit improved to 1.3% of GDP, helping maintain macro stability despite currency pressures and volatile global capital flows.

In contrast, global markets displayed growing signs of fatigue. The Nasdaq 100 declined during the month amid profit-taking in AI-linked stocks, while China and Hong Kong equities weakened on sluggish macro data and muted policy traction. Precious metals outperformed as investors sought safety, and crude oil prices softened ahead of expected rate cuts by the US Federal Reserve. Against this backdrop, India’s relative stability, predictable policy environment and domestic flow resilience helped it extend its outperformance.

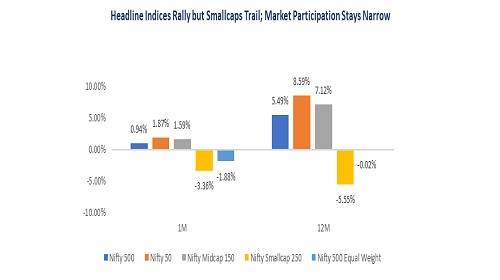

Despite the strong rally in headline indices, PL Asset Management cautions that market participation remains narrow, an important theme highlighted in its quantitative indicators. Only 22% of stocks are outperforming the Nifty 50 on a 12-month basis, while just 28% of stocks are trading above their 50-day exponential moving average — both metrics sitting near historically depressed levels. Additionally, only 23% of stocks are generating positive rolling alpha, compared with a long-term average of 46%.

Historically, such extreme narrowness in participation has often preceded phases of mean reversion and broader market recovery. The Nifty-Gold one-year return spread has moved into deeply negative territory — a signal that has, in the past, marked inflection points where investor preference begins to shift from safe-haven assets toward growth-oriented equities.

Mr. Siddharth Vora, Head - Quant Investment Strategies & Fund Manager, PL Asset Management, said, “Indian markets continue to demonstrate relative resilience at a time when global risk assets are undergoing a phase of recalibration. The recent correction across AI-driven global equities and the sharp drawdown in crypto assets reflect an unwinding of excess valuations rather than a deterioration in underlying growth. In contrast, India is benefiting from a rare combination of record-low inflation, improving earnings visibility and strong domestic liquidity support. As global capital gradually rotates away from crowded AI and speculative crypto trades, markets with stable macros and normalized valuations are likely to attract incremental flows. Looking ahead, improving market breadth, a recovery in earnings revisions and sustained SIP-led domestic participation should support a more broad-based and durable uptrend for Indian equities through FY26 and into 2026.”

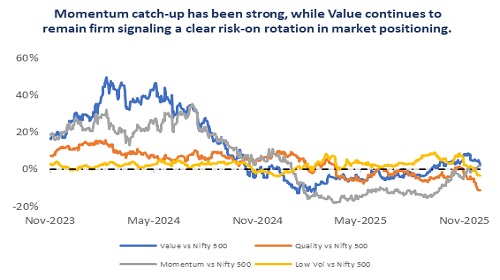

PL Asset Management’s proprietary valuation and sentiment indicators further support this view. The firm’s Value-Meter places the market firmly in the “attractive” zone, indicating scope for re-rating as growth expectations and foreign participation improve. The Risk-o-Meter suggests that markets may have moved past peak pessimism, while momentum-catch-up indicators and a positive high-beta versus low-beta spread point toward a gradual shift into a more risk-on environment.

PL Asset Management’s AQUA strategy delivered a gain of 2.22% in November, outperforming the BSE 500 TRI, which rose 0.96%. The performance was supported by strong midcap selection and core exposure to Financials, Materials, Industrials and Automobiles, alongside a balanced allocation across large, mid and small-cap stocks. Since inception in June 2023, AQUA has generated returns of 24.19%, compared with 18.86% for the benchmark, driven by diversified factor exposure across momentum, value and quality.

Looking ahead, PL Asset Management believes that the convergence of macro stability, easing inflation, improving earnings momentum and sustained domestic flows creates a favourable environment for Indian equities into 2026. While near-term volatility cannot be ruled out amid global uncertainties, the broader setup suggests that the current phase of narrow leadership could gradually give way to a more inclusive and durable market recovery.

Above views are of the author and not of the website kindly read disclaimer