India Strategy : New listings, old issues By Kotak Institutional Equities

New listings,

old issues We note the subdued performance of recent IPOs, which may influence the investment decision of investors for new issuances. Institutional investors appear increasingly selective, favoring issuers with strong fundamentals and issuances with reasonable valuations. Retail investors may also turn more selective given the recent underperformance and limited listing gains.

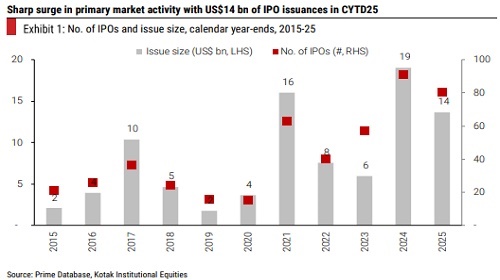

US$14 bn of equity issuance through IPO in CYTD25; US$19 bn in 2024

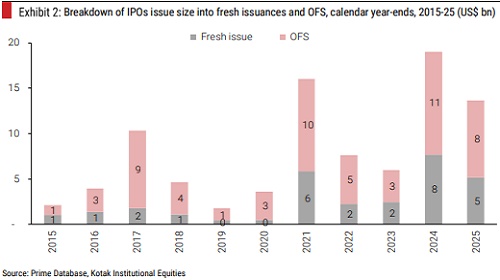

The Indian primary market has seen large issuances in 2025, following a stellar 2024. In CYTD25, 80 companies have raised US$14 bn through IPOs compared to 91 companies raising US$19 bn in 2024 (see Exhibit 1). Offer for sale (OFS) continues to outweigh fresh capital in the overall IPO issuance during the past few years (see Exhibit 2). Exhibit 3 shows the key objects of IPO fundraising in 2021 and 2025. (1) Retirement of debt, (2) working capital and (3) expansions are the key objects of fundraising.

38% of companies trading below their issue price over 2021-25

An increasing number of IPOs have witnessed tepid listings in CYTD25, with only 15% of companies delivering >25% return compared to 41% in 2024 (see Exhibits 4-6). Furthermore, over 2021-25, almost 27% of companies listed below their issue price. Lastly, data shows that a significant proportion of companies failed to maintain their gains even after a decent listing. Currently, 38% of companies are trading below their issue price (see Exhibits 7-8). The performance would be even weaker (1) relative to market returns or (2) adjusted for time based on a reasonable cost of capital.

Listing day highs, long-term lows

We note that a significant number of companies have struggled to surpass the gains achieved on their listing day, even for the most highly subscribed IPOs during 2021-25. This trend highlights a growing disconnect between initial investor enthusiasm and post-listing performance. Exhibit 9 shows the performance of highly subscribed IPOs over 2021-25. A similar trend has been observed among companies that delivered stellar returns on their listing day but failed to sustain the momentum (see Exhibit 10). We note that large- and mid-sized IPOs have fared better than small-sized IPOs; the broader trend suggests that investor enthusiasm is becoming more selective and valuationsensitive (see Exhibit 11).

Large IPO pipeline of US$35 bn

The IPO pipeline remains quite robust, with more than 200 companies expected to raise US$35 bn. We note that the bulk of the IPO pipeline comprises smaller IPOs, with (1) issuances of less than Rs10 bn accounting for 67% of issuances and 38% of issue value, (2) issuances between Rs10 bn and Rs25 bn accounting for 18% of issuances as well as 18% of issue value and (3) issuances above Rs50 bn comprising 4.3% of issue count and 24% of issue value (see Exhibit 12).

Please refer disclaimer at https://www.kotaksecurities.com/disclaimer

SEBI Registration No. INZ000200137