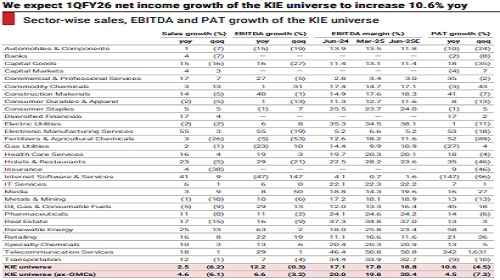

India Strategy : June 2025 quarter earnings preview by Kotak Institutional Equities

We expect 1QFY26 net income of the KIE universe to increase 10.6% yoy, largely driven by a strong rebound in profits of the oil marketing companies (OMCs). Excluding OMCs, net income will see a modest increase of 4.5% yoy. The net income of OMCs will rise sharply, driven by higher GRMs and strong marketing margins. Among sectors, we expect (1) construction materials (improvement in realization on account of price hikes), (2) healthcare services (higher footfalls in existing beds, new bed additions and a slight increase in ARPOB), (3) renewable energy (solar capacity additions) and (4) telecommunication services (higher ARPUs) to report strong yoy growth in net income. We expect single-digit earnings growth for (1) consumer durables & apparels, (2) electric utilities and (3) IT services sectors. Meanwhile, (1) automobiles & components (led by TTMT), (2) banks (persisting pressure from NIM compression), (3) consumer staples (margin pressure due to RM inflation), (4) gas utilities and (5) transportation sectors will report weak earnings growth. We expect 1QFY26 net profits of the BSE-30 Index to increase 6.1% yoy and of the Nifty-50 Index to increase 4.1% yoy. We estimate the ‘EPS’ of the BSE-30 Index at Rs3,700 for FY2026 and Rs4,308 for FY2027 and of the Nifty-50 Index at Rs1,125 for FY2026 and Rs1,300 for FY2027.

Above views are of the author and not of the website kindly read disclaimer