India Strategy : FII Monthly Flow Tracker By Jainam Financial Institutional Securities

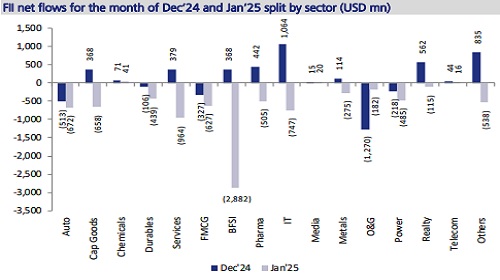

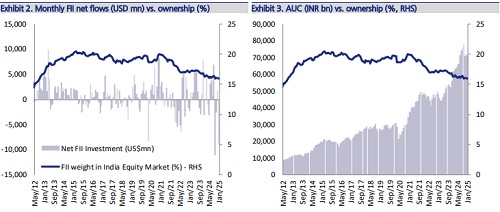

In Jan’25, FIIs offloaded INR 723bn (USD 8.4bn) worth of stock, continuing their selling streak after a break in Dec’24 (inflows of INR 11bn/ USD 1.3bn). Unlike Nov’24 and Dec’24, both of which were a tale of two halves, Jan’25 witnessed FII selling on 22 out of 23 trading days in the month. Since Oct’24, when FII started extensively selling stock, they have sold a total of INR 1.7trln/ USD 20bn worth of stock. In Jan’25, they remained net sellers in virtually all sectors barring chemicals, media and telecom, which saw negligible inflows of USD 41mn, USD 20mn and USD 16mn respectively.

* FIIs were sellers for 22 out of 23 trading days in Jan’25:

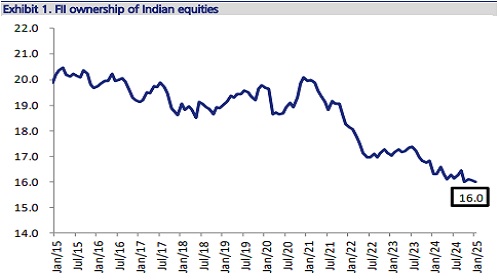

In Jan’25, FIIs offloaded INR 723bn (USD 8.4bn) worth of stock. Unlike Nov’24 and Dec’24, both of which were a tale of two halves, Jan’25 witnessed FII selling on 22 out of 23 trading days in the month. FII shareholding in Indian equities was 16.0% as of Jan’25, which was similar to what was witnessed in Oct’24; a 12-year low. As of end-Jan’25, FII Equity Assets under Custody (AUC) stood at INR 67.7trln, 5% lower than INR 71.1trln as of Dec’24.

* BFSI, IT and Auto saw the largest FII outflows:

Sectors that saw the highest outflows included BFSI and IT of USD 2.8bn and USD 747mn respectively, both of which had witnessed inflows in Dec’24. Oil and Gas (5th consecutive month) and autos (6th consecutive month) also witnessed selling of USD 182mn and USD 672mn respectively.

* Chemicals, media, and telecom saw FII inflows:

Chemicals, media, and telecom saw negligible inflows of USD 41mn, USD 20mn and USD 16mn respectively.

FII shareholding in Indian equities was 16.0% as of Jan’25, slightly lower sequentially and flat vs. Oct’24, which was a 12-year low. However, it remains lower YoY (16.3% in Jan’24). As of end-Jan’25, FII Equity Assets under Custody (AUC) stood at INR 67.7trln, 5% lower than INR 71.1trln as of Dec’24.

Please refer disclaimer at https://jainam.in/

SEBI Registration No.: INZ000198735, Research Analyst: INH000006448, PMS: INP000006785