India's Paytm gets government nod for investment in payments arm

India's Paytm has received an approval from the country's finance ministry to invest in its payment services business, the fintech firm said on Wednesday.

One 97 Communications, popularly known as Paytm, has been under the scrutiny of India's banking regulator and financial crime-fighting agency after the central bank ordered it to wind down its payments bank in January.

With the latest approval, the company will resubmit an application with the ministry to regain a license for its payments services business, Paytm said.

In the meantime, Paytm Payment Services will continue to provide online payment aggregation services to existing partners, the company said.

Paytm did not share details of the investment that has been approved.

In July, Reuters had reported, citing a top finance ministry official, that Paytm had secured approval for a 500 million rupee (about $6 million) investment in its payments arm.

Paytm Payment Services is one of the biggest remaining parts of the fintech firm's business and had accounted for a quarter of its consolidated revenue in the financial year ended March 2023.

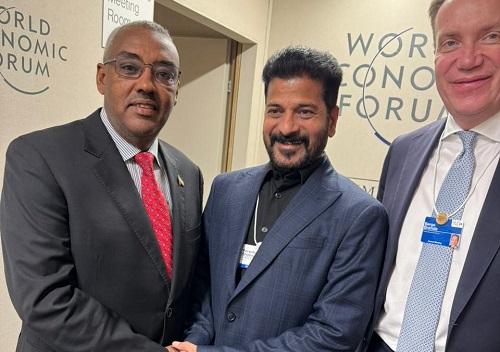

Vivek Joshi, India's financial services secretary, had said in July that the company can approach India's central bank to seek a payment aggregator license, which the bank will evaluate.

Shares of Paytm closed 1.3% lower on the day. They have fallen more than 29% since January, when the central bank had ordered a wind down of the payment bank.

($1 = 83.9300 Indian rupees)