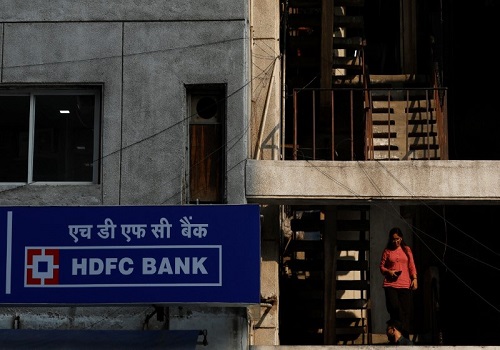

India`s HDFC Bank slides on margin concerns

Shares of India's HDFC Bank stock fell as much as 7% on Wednesday, marking their worst intraday fall since May 2020, after the country's biggest private lender reported weak margins for a second consecutive quarter.

While HDFC Bank's standalone net profit for the third fiscal quarter beat analysts estimates, its core net interest margin (NIM) on total assets fell to 3.4% from 3.65% in the previous quarter.

Those margins were above 4% for the bank before it merged with parent Housing Development Finance Corp (HDFC) in July last year.

Since then, HDFC's higher borrowing costs and a lower-yielding loan book have weighed on the margins in the two quarters it has reported results as a merged entity.

Brokerage Jefferies said margins were a "key miss" and that higher retail deposit mobilisation and lending will be key to lifting NIMs.

HDFC Bank's stock was last down about 6% on Wednesday and was the main reason for the benchmark Nifty 50 index's 1% drop.

"Improvement in NIM is critical for re-rating of the stock," Macquarie said in a report late on Tuesday.

HDFC Bank's stock rose around 5% in 2023, less than the 12.3% jump in the Nifty Bank index and a 20% gain in the Nifty 50. ($1 = 83.1325 Indian rupees)