India Clean Power Auctions: Hitting New Highs

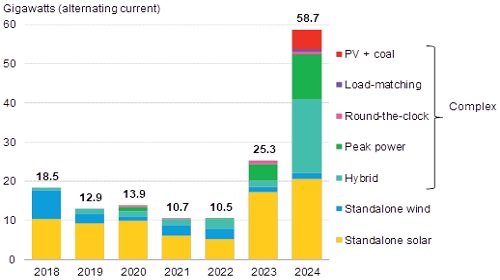

India’s annual clean power auctions grew 2.3 times to reach 59 gigawatts (alternating current) in 2024. This was the second consecutive year in which India more than doubled its annual renewable auction volumes. Power producers are moving away from standalone solar and wind auctions to complex projects – those that require combinations of wind, solar and energy storage.

* A rising variety of complex auctions: Hybrid auctions require a simple combination of wind and solar projects and they accounted for more than half of the complex auction volumes awarded in 2024. Peak power projects nearly tripled from 2023. Last year marked the first successful auction of a load-following complex tender in which generators are asked to meet a representative monthly electricity demand profile, on an hourly basis.

* Solar tariffs fell marginally but wind is becoming more expensive. The weighted average tariff at standalone solar auctions dipped 2% in 2024 to 2,597 rupees per megawatt-hour. A substantial fall in module prices – which account for up to 50% of utility-scale solar project costs – did not translate to a drop in tariffs of a similar magnitude. This indicates that bidders have built in some buffers to account for any rise in module prices due to import tariffs and a push toward higher local content in solar modules. The tariffs discovered at wind auctions rose by 13% to 3,607 rupees/MWh. A rise in wind turbine costs and lower bidder turnout at auctions are the likely reasons for this increase in tariffs. Hybrid auctions have seen tariffs climb every year from 2021 as developers consider the costs of both wind and solar technologies.

* Top winners and the lure of manufacturing. Avaada, JSW Energy and Adani Green were the top winners of India’s 2024 clean power auctions. The first two won more capacity than they had in any previous year. The top five winners (barring Juniper Green) are either entering or expanding equipment manufacturing. This vertical integration grants the independent power producer’s (IPP) operations team greater supply chain certainty, while its factories have assured demand from the pipeline of projects secured.

* Private power companies are ramping up while government-owned entities have stepped back. Indian private IPPs made up 86% of all bids last year, up from about two-thirds in the past two years. Their absolute volume of capacity bid in 2024 more than tripled from 2023. Foreign IPPs bid for more capacity than in the past, but their share fell from 17% in 2022 to 8% in 2024. Government-owned IPPs scaled back their auction activity, placing only 5.4GW(AC) of bids in 2024 compared to 10GW(AC) in 2023.

* New winners: Rising renewable energy auction volumes and growing power demand attracted new IPPs last year. In 2024, 15 IPPs won for the first time at solar auctions and 22 at complex auctions. Debut complex auction winners included conglomerates Essar Renewables, Hinduja Renewables Energy, JSW Energy, Reliance Power (Anil Dhirubhai Ambani Group) and Torrent Power; and foreign IPPs BrightNight, Gentari, Sembcorp Energy, UPC Renewables, and Vena Energy.

Above views are of the author and not of the website kindly read disclaimer