India Banks - Sep'25 update by JM Financial Services

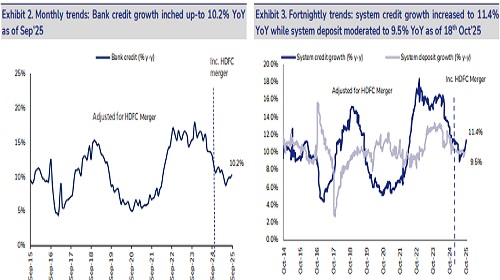

According to the latest fortnightly data as of 18th Oct’25, system credit growth edged higher to 11.4% YoY (from 10.4% YoY on 19th Sep’25), while deposit growth was flat at 9.5% YoY. The system credit-deposit ratio remains elevated at around 80% as of Oct’25. RBI’s sectoral credit data for Sep’25 shows a slight uptick in overall system credit growth to 10.2% YoY (from 9.9% YoY in Aug’25), primarily driven by credit expansion in the agriculture and industry sectors. Credit to agriculture grew by 7.3% YoY in Sep’25 (vs. 6.5% YoY in Aug’25), while credit to industry rose by 9% YoY (up from 7.6% YoY in Aug’25). Retail loans growth was steady at ~11.7% YoY (compared to 11.8% YoY in Aug’25), though growth in services credit moderated to 10.2% YoY (vs. 10.6% YoY in Aug’25). Within industry, MSMEs led the growth, expanding by 19.7% YoY (up from 18.5% YoY in Aug’25). Meanwhile, credit to NBFCs, while still muted, edged up to ~3.9% YoY (vs. 3.4% YoY in Aug’25).

Lending rates on fresh loans have been cut by ~24bps MoM to 8.5% in Sep’25 led by a 25bps MoM cut by PSU banks. On an outstanding basis, lending rates have moderated by ~6bps MoM in Sep’25, and by an overall 54bps since Feb’25, outpacing the ~28bps reduction in outstanding term deposit rates, thereby exerting continued pressure on NIMs for banks. On O/s basis, spread between lending rates and deposit rates for both PSU and PVT banks were largely steady MoM (-2bps/+2bps MoM at 172bps/326bps respectively). Since Feb’25, transmission on the liability side has been fairly consistent for both PSU and PVT banks (-25bps/-24bps respectively), whereas on the asset side, the transmission for PSU banks (-47bps) have lagged PBT banks (- 63bps). Except for 1Y/5Y NBFC AAA, NBFC yields for all other tenors/ratings were up by ~6- 10bps MoM in Oct’25.

We continue to remain positive on banks given inch up in credit growth, NIMs bottoming out and benign/improving asset quality. Our preferred names in banks are: Axis, ICICI, BoB, SBI, HDFC Bank, CUBK, Ujjivan and DCB Bank.

* Segment-wise loan growth trends: System retail credit growth was steady at 11.7% YoY in Sep’25 (vs. 11.8% YoY in Aug’25). Within retail, vehicle loan growth declined to 7.3% YoY (vs. 8.7% YoY in Aug’25) and unsecured retail loans to 7.5% YoY (vs. 7.8% YoY in Aug’25). In contrast, the housing segment saw a modest uptick, with growth rising to 10.1% YoY (vs. 9.7% YoY in Aug’25). Within the housing segment, priority HLs grew at ~29.9% YoY (vs. ~26.2% YoY in Aug’25), while non-priority HLs saw a slight moderation to 3% YoY (vs. 3.8% YoY in Aug’25). Despite continued stress concerns in the MSME sector, credit growth increased to 19.7% YoY (vs. 18.5% YoY in Aug’25). Services sector loan growth moderated to 10.2% YoY (vs. 10.6% YoY in Aug’25). Agricultural credit improved to 9.0% YoY (vs. 7.6% YoY in Aug’25), while industrial credit growth improved modestly to 7.3% YoY (vs. 6.5% YoY in Aug’25). Credit extended to NBFCs, though muted, rose to ~3.9% YoY compared to 3.4% YoY in Aug’25.

* System liquidity bounces back to surplus; forex reserves moderate: System liquidity rebounded to a surplus of ~INR 1.1trln as of 2nd Nov’25, following a brief deficit of ~INR 0.6trln recorded on 21st Oct’25. Foreign exchange reserves moderated MoM to USD 695bn as of 24th Oct’25, down from USD 700bn on 26th Sep’25. Currency-in-circulation rose slightly to ~INR 37.9trln as of 17th Oct’25, compared to ~INR 37.6 trln as of 19th Sep’25. The benchmark 10- year G-sec yield and the US 10-year Treasury yield both eased by 5bps MoM in Oct’25 to ~6.5% and 4.1%, respectively, maintaining a steady spread of 242bps between the two. Despite the Fed’s 25bps rate cut on 29th Oct’25, US Treasury yields across various maturities have remained stable, reflecting on-going inflation concerns.

* Our view: We continue to remain positive on banks given inch up in credit growth, NIMs bottoming out and benign/improving asset quality. Our preferred names in banks are: Axis, ICICI, BoB, SBI, HDFC Bank, CUBK, Ujjivan and DCB Bank.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361