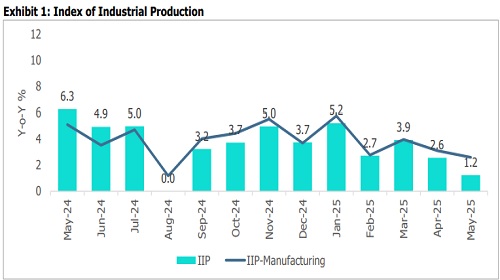

IIP Growth Moderated to 1.2% in May 25 by CareEdge Ratings

As expected, growth in India’s industrial production eased to a 9-month low of 1.2% in May. The moderation was led by a slowdown in manufacturing growth, coupled with contraction in both the mining and electricity sectors. On the consumption front, weakness in consumer non-durable goods output continued, while growth in consumer durables turned negative after recording encouraging growth in the preceding months. Overall, a pickup in consumption remains crucial for industrial performance, particularly amid persistent weakness in urban demand.

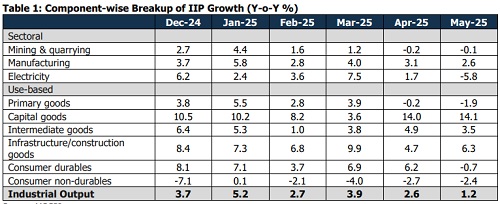

In terms of use-based classification, the output of infrastructure and construction goods showed encouraging performance, rising by 6.3% (Vs 4.7% in April). Moreover, capital goods output rose by a healthy 14.1%, logging double-digit growth for two months in a row. Output of consumer non-durable goods contracted by 2.4%, staying in the negative territory for four months in a row. Growth in consumer durables slipped into the negative territory (-0.7%) following encouraging growth in the preceding months.

Way Forward Going ahead, the continued improvement in the inflation scenario, particularly in the food inflation, along with the RBI’s recent policy rate cut, bodes well for consumption in the economy. However, demand recovery remains uneven, with lagging urban demand. Moreover, global economic uncertainty is expected to persist going forward, which would have a further bearing on the investment landscape. Overall, the demand and investment situation remains to be monitored going forward

Above views are of the author and not of the website kindly read disclaimer