Hold Punjab National Bank Ltd For Target Rs.78 - Motilal Oswal Financial Services

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

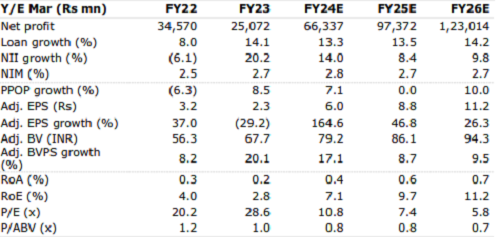

PNB reported a beat on PAT, at Rs17.6bn (vs Emkay: Rs14.6bn), mainly owing to higher NII, lower staff expense and contained provisions, and partially offset by the higher tax expense. Bank’s credit growth trajectory improved to 15% YoY/3% QoQ which, coupled with better loan/investment, led to a 3bps QoQ improvement in NIM to 3.1%, while most banks saw a correction. Asset quality continues to enhance, with GNPA ratio down by 77bps QoQ to 7%, aided by lower slippages and higher recoveries/upgrades. Going ahead, PNB expects growth to remain robust, albeit NIMs to slightly soften amid rising CoF. However, better treasury gains, recovery from written-off accounts and contained LLP should support profitability. We expect the bank to note a gradual improvement in RoA/RoE to 0.7%/11% by FY26E, from a low of 0.2% in FY23. We retain HOLD on PNB, with new TP of Rs78/sh (earlier Rs65), rolling forward on Sep-25E ABV and subs value at Rs5/sh. Management clarified the bank is not looking to divest stake in subsidiaries, incl. its insurance business, for now.

Punjab National Bank: Financial Snapshot (Standalone)

Growth improves, as do margins

Credit growth improved to 15% YoY/3% QoQ, backed by continued growth in the RAM segment (which constitutes 56% of the total loan book), while Corporate growth was muted at 1% QoQ. Total deposits grew 10% YoY/1% QoQ, with CASA remaining stable at 41%. Despite the increase in CoF to 4.3% (due to repricing of deposits), NIMs saw a slight improvement of 3bps QoQ to 3.1%, owing to better yield on loans/investments. The bank conservatively guides for 12-13% credit growth in FY24 with upward bias and NIM of 2.9-3%, as it envisages further increase in CoF due to repricing of deposits.

Lower slippages lead to sharp improvement in asset quality

Lower fresh slippages at Rs18.3bn/0.9% of loans, coupled with higher recovery/ upgrades, led to a 77bps QoQ decline in the GNPA ratio to 7%. Specific PCR further improved to 80%; the bank plans to maintain this high level and thus bring down the NNPA from its current 1.5% levels. The restructured pool also declined, by 7bps QoQ to 1.1% of loans, and stands at Rs101bn. The bank recovered NPAs to the tune of ~Rs11bn from NCLT in H1FY24, and expects more recoveries, of Rs25bn in H2FY24. The bank guides for credit cost of 1.5-1.75% for FY24 vs 2.1% in FY23.

We retain HOLD on the stock

We expect the bank to report gradual improvement in its RoA/RoE to 0.7%/11% by FY26E, from a low of 0.2% in FY23. We retain HOLD on the stock, with revised target price of Rs78/share (earlier Rs65/share), rolling forward on Sep-25E ABV and subsidiaries’ value at Rs5/share. Management has clarified that the bank is not looking to divest stake in its subsidiaries, including its insurance business, for now. Key risks: Macro deterioration derailing growth/asset-quality normalization.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf

& SEBI Registration number is INH000000354

.jpg)