High Conviction Idea: Buy HDFC Life Insurance Company Ltd For Target Rs. 870 By Religare Broking

HDFC Life Insurance, initially a joint venture between HDFC and Standard Life Abrdn, is now majority-owned by HDFC Bank following Abrdn’s exit. The company offers a broad spectrum of insurance products through its subsidiaries, HDFC Pension and HDFC International, supported by a robust multi-channel distribution network. With 600 branches and 2.4 lakh agents, it has strengthened its presence, particularly in Tier 2/3 markets, where growth has exceeded overall company performance. As the second-largest private life insurer, HDFC Life boasts industry leading Value of New Business (VNB) margins, a diversified product portfolio, high persistency ratios, and a strong commitment to digital transformation and strategic expansion.

Consistent track record over business cycles: It has consistently outperformed the industry, growing at twice the average pace over the last decade while maintaining strong profitability. Driven by a well-diversified portfolio, bancassurance alliances, Tier 2/3 markets expansion, and digitalization, it achieved impressive CAGR growth across key segments, including 30.67% in protection and 43.59% in annuities. With persistency ratios rising from 79% in FY16 to 87% in FY24, HDFC Life’s focus on customer retention, innovation, and strategic expansion positions it as a market leader.

Strengthening growth amid market shifts: Company is reinforcing its leadership in the non-par segment with innovative guaranteed-return products, despite near-term pressures from new tax regulations and rising ULIP demand. The company is recalibrating its product mix, targeting a ULIP share below 30%, while redesigning non-par offerings to stay competitive. Simultaneously, its strategic expansion in Tier 2/3 markets, contributing 65% to Annualized Premium Equivalent (APE) and three-fourths to New Business Operating Profit (NOP), is driving longterm growth. With deeper micro-market penetration, a strengthened distribution network, and rising persistency ratios, HDFC Life remains well-positioned for sustained profitability.

Protection to lead growth with margin resilience: Company continues to drive strong growth in its retail protection segment, with a 27% YoY increase and a 36% two-year CAGR in H1 FY25, while protection and annuities contribute 44% to new business premiums. Despite near-term margin pressure from a shift in product mix and rising ULIP sales, the company remains focused on long term profitability through strategic channel expansion and innovation. While FY25E margins may see slight contraction, improvements are expected from FY26E as non-par savings regain traction and commission costs stabilize. HDFC Life remains committed to sustainable growth, even if it involves a short-term margin trade-of

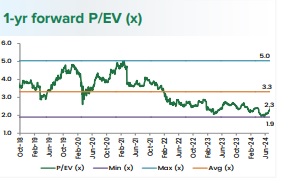

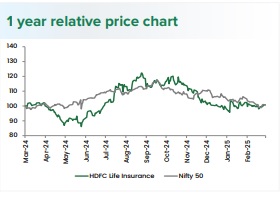

Potential re-rating on sustained industry leadership: It has historically traded at a premium, faced valuation derating post-COVID due to regulatory changes. However, with most uncertainties now priced in and strong growth driven by a diversified portfolio, bancassurance, and digital expansion, downside risks appear limited. A potential re-rating remains possible as the company sustains its industry-leading performance.

Valuation and Outlook: HDFC Life’s strong brand, differentiated products, and solid execution have driven premium valuations and industry-leading profitability. While near-term non-par challenges persist, margin improvement is expected from FY26. Expansion in Tier 2/3 markets, protection growth, and strong bancassurance partnerships remain key drivers. We expect a 17.3% Embedded value (EV) CAGR projected over FY24-27E and see limited downside risks, hence we initiate coverage with a Buy rating, valuing HDFC Life at 2.6x FY27E EV with a target price of Rs. 870.

Please refer disclaimer at https://www.religareonline.com/disclaimer

SEBI Registration number is INZ000174330