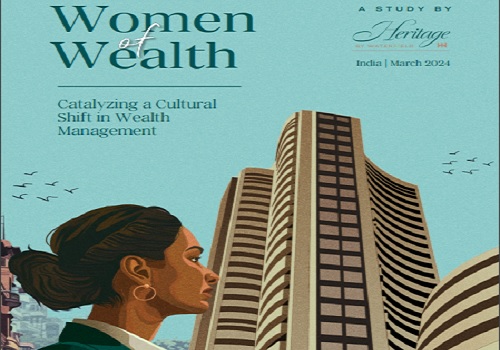

HERitage by Waterfield Advisors unveils Women of Wealth Report - A Study on Wealth Management Trends of HNI Women in India

HERitage by Waterfield Advisors has unveiled insightful findings from a survey of 104 HNI Indian women about how they invest and manage their wealth in its latest comprehensive report – Women of Wealth.

The focused survey was conducted among 104 Indian women living in tier-1 cities having a net worth of above INR 10 Crores. The respondent group has a vast age range of 22 to 60 and a variety of professions – Corporate salaried professionals, Entrepreneurs, Self-employed professionals (lawyers, doctors, interior designers etc), and Homemakers. The survey intended to identify how this economically strong group of women are investing their wealth, the support they receive from their family and wealth management partners, and to ascertain whether there is a need for a differentiated approach to wealth management for women.

The report reveals transformative findings. There is an interesting mix of high intent and low action, thus illuminating the gaps between the investment aspirations of UHNI Indian women and the current wealth management offerings. Moreover, they also point towards actionable pathways for firms to align more closely with their female clients’ needs and preferences.

The key findings from the report –

v Intent

o 95% of respondents show interest in investing in atleast one asset class.

o Listed Equities (61.9%) is more favoured than Gold (54.3%) and Real Estate (41%).

o Alternative Investments find as much interest as Debt Funds (35%).

o 41% identify as having a broad understanding of investments.

v Inaction

o 58% of the respondents regard themselves as risk-averse.

o 47% of the respondents are strongly involved in family’s investment decisions, but 42% of homemakers are not involved at all.

o 65% of self-employed professionals are not very satisfied with their wealth manager, along with 50% of entrepreneurs and 53% of corporate professionals.

v Integration

o More than 80% of the respondents show a strong belief in the need for dedicated wealth management for women in India.

The call for more engaging, educational, and personalized wealth management experiences for women is clear.

Commenting on the findings, Nita Shivdasani, Managing Director & Head of HERitage, Waterfield Advisors, states, “The journey of financial enlightenment and empowerment for women diverges significantly from that of men, driven by distinct needs, risk profiles, and societal roles. Our survey findings echo the collective voice of affluent Indian women for a paradigm shift in how wealth management services are conceptualized and delivered, advocating for strategies that are more aligned with their distinct financial goals, risk appetites, and life stages.”

Heritage by Waterfield Advisors is a first-of-its-kind holistic wealth advisory service crafted exclusively for women founders, entrepreneurs, inheritors, and senior corporate professionals.

Above views are of the author and not of the website kindly read disclaimer