Growth momentum quickens in Q2FY25, inflation in food basket remains concern: RBI Bulletin

The Reserve Bank of India’s (RBI) July Bulletin released that the second quarter of 2024-25 (Q2 FY25) has begun with signs of quickening momentum in the economy though inflation in the food basket remains a concern. An article on ‘State of the Economy’ in the monthly Bulletin also said the improvement in the outlook for agriculture and the revival of rural spending have turned out to be the bright spots in the evolution of demand conditions.

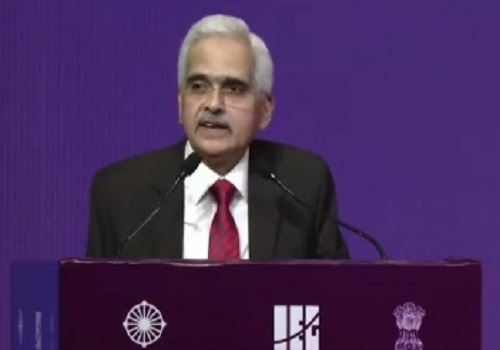

The article authored by a team led by RBI deputy governor Michael Debabrata Patra said consumer price inflation ticked up in June 2024 after three consecutive months of moderation as a broad flare-up in vegetable prices halted the overall disinflation that had been underway. It said the argument that food price shocks are transitory does not seem to be borne out by the actual experience over the past one year – too long a period for a shock to be termed as transitory. Superimposed on this ‘persistent’ component are sporadic spikes in prices of a range of vegetables that overlap across constituents to give the broader category of vegetable inflation an enduring character.

The article said food prices are clearly dominating the behaviour of headline inflation and households’ inflation expectations, undermining the gains of lowering core and fuel inflation through a combination of monetary policy and supply management. Given the high uncertainty shrouding the inflation outlook, it is prudent to eschew the temptation of time inconsistency and stay the course on the straight and narrow path of aligning inflation with the target of 4 per cent. This does not imply that inflation should reach 4 per cent and stay there before monetary policy considers a change in stance; instead, based on a careful evaluation of the balance of risks, an enduring movement towards the target should provide signals to forward-looking monetary policy to respond.