FY25 Loses Momentum and Closes with Subdued Business Growth by CareEdge Ratings

Synopsis

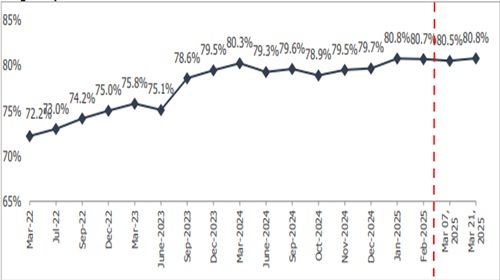

Credit off-take experienced a slight increase over the past fortnight, while deposit growth decelerated. Consequently, the gap between credit and deposit growth has marginally narrowed from 0.88% in the previous fortnight to 0.75% in the current fortnight. This is a notable change compared to the same period last year, when the gap was significantly larger at 6.70%.

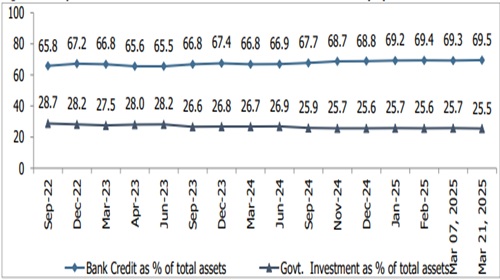

* As of March 21, 2025, credit offtake reached Rs 182.4 lakh crore, marking an increase of 11.0% yearon-year (y-o-y), slower than last year’s rate of 16.3% (excluding merger impact). The slowdown reflects a higher base effect, as well as concerns about elevated credit-to-deposit ratio.

* Deposits rose 10.3% y-o-y, totaling Rs 225.7 lakh crore as of March 21, 2025, a decrease from 12.8% the previous year (excluding merger impact). This slower growth is primarily attributed to losing share of household deposits, a higher base effect and lower interest rates on deposits.

* The Short-Term Weighted Average Call Rate (WACR) has decreased to 6.35% as of March 28, 2025, down from 6.58% on March 22, 2024.

Bank Credit Growth Rate Witness a Marginal Downtick for the Fortnight

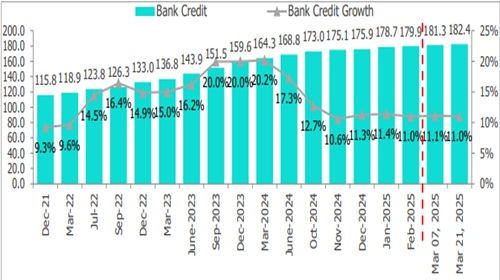

Figure 1: Bank Credit Growth Trend (y-o-y %, Rs. Lakh crore)

Note: Bank credit growth and related variations for all fortnights since December 3, 2021, are adjusted for past reporting errors by select scheduled commercial banks (SCBs). The quarter-end data reflects the previous fortnight’s data for that quarter. Source: RBI, CareEdge Ratings

• Credit off-take rose by 11.0% y-o-y and by 0.7% sequentially for the fortnight ending March 21, 2025, yet it came in slower than the previous year’s growth of 16.3% (excluding the merger impact). This slowdown can be attributed to a higher base effect, as well as RBI’s commentary on a high credit-to-deposit ratio, slower pace of growth in personal loans, and advances to NBFCs.

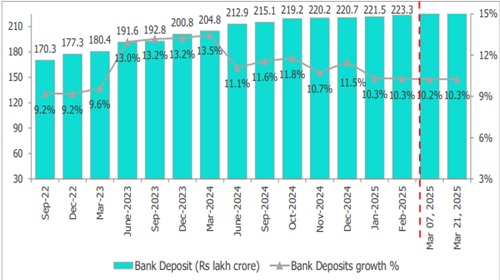

Figure 2: Bank Deposit Growth Witnesses a Marginal Uptick for the Fortnight (y-o-y %)

Note: The quarter-end data reflect the last fortnight’s data of that quarter; Source: RBI, CareEdge Ratings

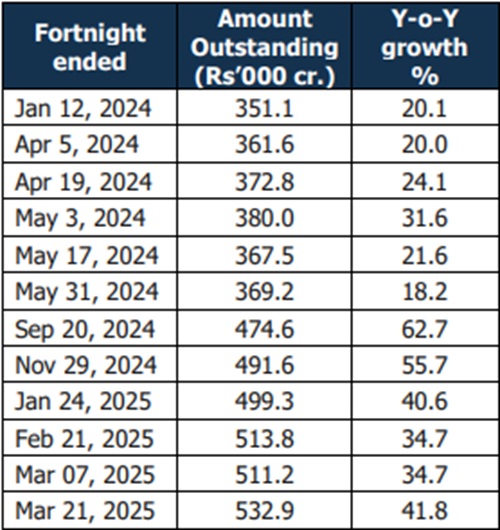

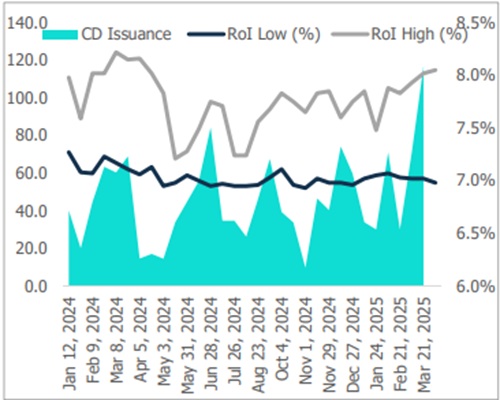

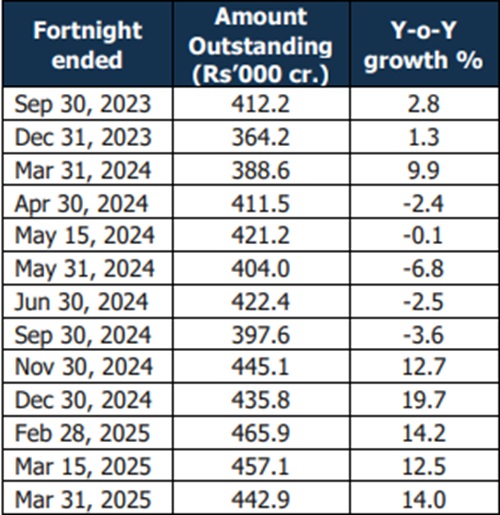

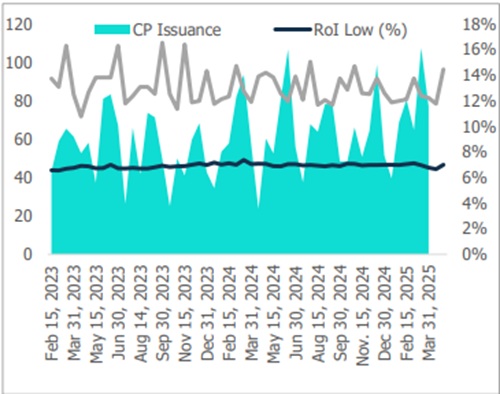

• Deposits increased by 10.3% y-o-y, reaching Rs 225.7 lakh crore as of March 21, 2025, which is lower than the 12.8% growth (excluding merger impact) recorded last year. In FY25, banks have intensified efforts to strengthen their liability franchises by offering higher interest rates on term deposits. Additionally, banks are raising funds through certificates of deposit, although at a higher cost. According to the RBI, the issuance of certificates of deposit (CDs) grew by 41.8% y-o-y to reach an all-time high of Rs 10.58 lakh crore as of March 21, 2025, in FY25. Similarly, commercial paper (CPs) issuances at Rs 15.750 lakh crore were 14.5% higher during FY25 (up to March 31, 2025) compared with the corresponding period a year ago. Further, the yields on CDs marginally increased from 7.49% to 7.52% during the same period. This surge reflects banks’ funding requirements.

Figure 3: Credit-Deposit (CD) Ratio Continues to Witness an Uptick, Remains Above 80% – Incl. Merger Impact

Figure 7: Commercial Paper Outstanding

Figure 8: Trend in CP Iss. (Rs’000, Cr.) and RoI

Above views are of the author and not of the website kindly read disclaimer

Tag News

Quote on Budget 2026 by Mr. NS Venkatesh, CEO, Bharat InvITs Association