Economic Pathways June 2025 by CareEdge Ratings

Economic Growth Momentum

GDP Growth Performs Better-than-Expected

• India’s GDP growth in the fourth quarter of FY25 came in at 7.4%, significantly exceeding expectations. This brings full year FY25 growth to 6.5%.

• GDP growth moderated in FY25 from an average of 8.4% in the previous two years.

• We expect GDP growth to be around 6.2% in FY26.

Economic Growth Momentum

GDP Growth Drivers

• Agricultural growth remained healthy.

• Feeble manufacturing growth, though improved in Q4. Construction activity jumped sharply to 10.8% in Q4.

• Financial, real estate, and professional services have supported the services sector growth.

• Private consumption growth moderated in Q4 FY25. Rural demand continues to hold up well, while urban demand remains mixed.

• GFCF growth jumped sharply to 9.4% in Q4. However, government final consumption expenditure contracted, limiting overall growth.

Domestic Savings Scenario

Declining Savings and Rising Household Leverage

• Gross domestic savings declined to 30.7% of GDP in FY24 from 32.2% in FY15.

• Household savings fell for the third consecutive year, reaching 18.1% of GDP in FY24.

• Gross financial liabilities of households rose sharply to 6.2% of GDP in FY24, nearly doubling over the past decade.

Wage Growth Scenario

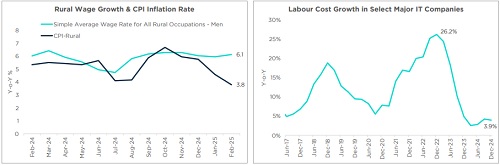

Rural Wage Growth Outpaces Inflation; Urban Wage Growth Remains Subdued

• The simple average wage rate for all rural occupations (men) increased by 6.1% (Y-o-Y) in February, consistently outpacing the rural inflation for four consecutive months.

• Growth in the cumulative labour cost of select major Indian IT companies fell to around 4% (Y-o-Y) in Q3 FY25 from a peak of 26% in Q3 FY23.

Above views are of the author and not of the website kindly read disclaimer