Economic Pathway November 2025 by CareEdge Ratings

Global Growth Outlook

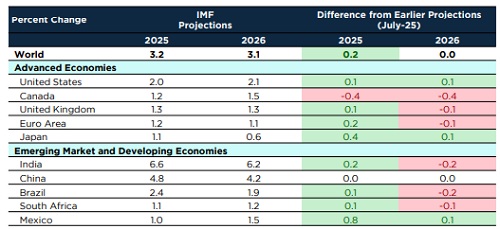

2025 Growth Forecasts Revised Higher

* 2025 Global growth forecast was revised slightly higher amid trade frontloading and gradual adaptation to trade tensions.

* Overall, risks to growth remain tilted to the downside amid continued uncertainty and rising protectionism.

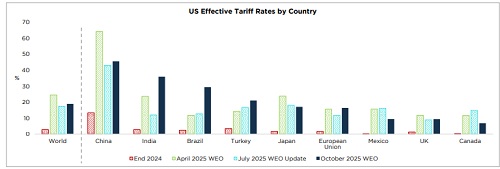

US Effective Tariff Rates by Country

US Tariff Rates Remain Elevated

* Trade deals between the US and its trading partners have brought down the US’s effective tariff rates from the levels seen in April.

* However, tariffs remain elevated compared to their 2024 levels.

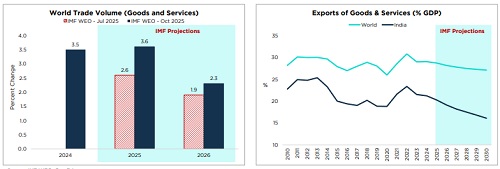

Global Trade Outlook

2025 Trade Forecasts Revised Higher Amid Frontloading

* Global trade volume is projected to grow at an average rate of 2.9% during 2025-2026.

* The average global trade forecast for 2025 and 2026 is revised higher from the July projections.

* IMF projects India’s exports of goods and services (% GDP) to moderate to ~16% by 2030 from 21% currently, in line with the projected decline in global trade.

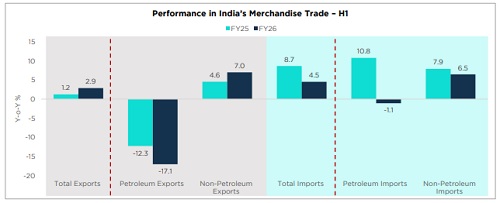

India’s Merchandise Trade Performance

Trade Frontloading Supported India’s Non-Petroleum Exports in H1 FY26

* India’s non-petroleum exports held up relatively well, rising by 7% in H1 FY26. However, petroleum exports remained a drag on overall export growth.

* Imports grew by a modest 4.5% during H1 FY26, led by non-petroleum imports.

India’s Merchandise Trade Performance

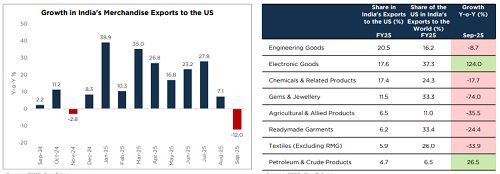

Merchandise Exports to the US Contracted in September

* The US is India’s largest export destination for merchandise goods, accounting for nearly 20% share in India’s total exports.

* India’s exports to the US rose by 13% in H1 FY26. However, in September, India’s exports to the US contracted by 12%, marking the steepest decline since June 2023.

* Amongst India’s major exports to the US, exports of all commodities except electronic goods and petroleum products have witnessed a contraction in September.

* Going ahead, the downside of the 50% US tariffs must be monitored closely.

Domestic High Frequency Indicators

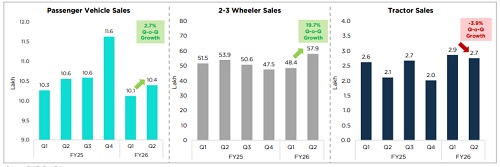

Auto Sales Performance

* Domestic auto sales of passenger vehicles and 2-3 wheelers witnessed a sequential uptick in Q2 FY26.

* Whereas domestic tractor sales witnessed some sequential moderation.

* GST reform introduced in September is expected to provide a boost to domestic auto sales in the upcoming months.

Domestic Inflationary Scenario

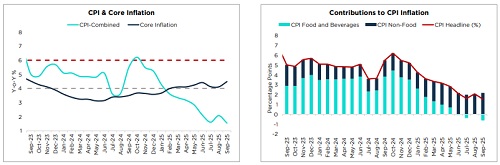

India’s CPI Inflation Eases Further

* CPI inflation eased to 1.5% in September, falling below the RBI’s lower target range of 2%, aided by a favourable base and softer food prices.

* Core inflation, however, edged up to 4.5% due to sustained double-digit inflation in precious metals. Excluding precious metals, core inflation remained benign at 3%.

* With food inflation subdued and demand-side pressures contained, we project average inflation for FY26 at 2.1%.

* From a monetary policy perspective, if growth weakens in H2 FY26, the latest inflation readings could create scope for a rate cut.

Bank Credit Offtake

Credit Expansion Witnesses a Slight Uptick

* Bank credit offtake picked up slightly in the recent months to 10.4% (Y-o-Y) as of Sep-25.

* This pick-up was supported by seasonal demand during the festive season and the impact of GST rate cuts.

* While bank credit offtake showed some signs of improvement, it remained lower compared to the 13% growth seen as of September last year.

* Amid moderating credit growth, the RBI has announced multiple measures to improve the flow of credit

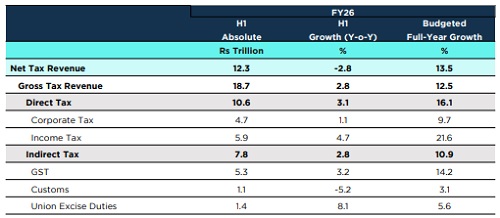

Central Finances – H1 FY26

Gross Tax Collections Slowed So Far in the Year

* Gross tax collections rose by just 2.8% (Y-o-Y) in H1 FY26, much lower compared to the budgeted annual growth of 12.5%.

* This moderation can be attributed to a slowdown in both direct and indirect tax collections.

* Income tax collections recorded double-digit growth in the last two months. This helped lift the H1 growth to 4.7%; however, it is still below the budgeted annual growth of 21.6%.

* Rationalisation of income tax slabs announced in the last Budget may have weighed on the performance of income tax collections so far this year.

* Lower nominal GDP growth might weigh on the tax buoyancy, thereby constraining the growth in tax collections.

* Furthermore, the net impact of GST rationalisation on the government’s tax revenue remains a key watch out for the remainder of the fiscal year.

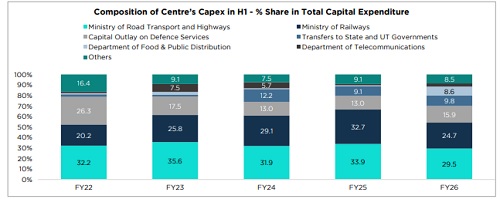

Central Finances – H1 FY26

Capex Continues to Record Encouraging Growth

* Centre’s capital expenditure surged by 40% (Y-o-Y) during H1 FY26.

* In H1 FY26, Rs 500 billion have been disbursed towards the Department of Food and Public Distribution, marking a notable increase over last year’s disbursement of Rs 39 billion.

* Centre’s capex, adjusted for disbursements to the Department of Food and Public Distribution, has risen by 29% in the fiscal year so far.

* Among other components, capex towards roads and railways rose by 21.7% and 5.6% (Y-o-Y), respectively, during H1 FY26.

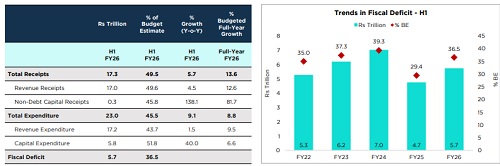

Central Finances – H1 FY26

Capex Continues to Record Encouraging Growth

* While tax collections remained subdued, the Centre’s non-tax revenues have been better-than-anticipated, buoyed by higher-than-budgeted dividend transfer from the RBI.

* On the spending front, capex remained healthy, exceeding the full-year targeted growth, while some rationalisation was seen in terms of the revenue expenditure.

* Overall, higher-than-anticipated support from non-tax revenues and some rationalisation in revenue expenditure helped contain the fiscal deficit at Rs 5.7 trillion in H1 FY26.

* Fiscal deficit is at 36.5% of the budget estimate, higher than 29.4% seen in H1 last year, but broadly in line with the levels seen in the earlier years.

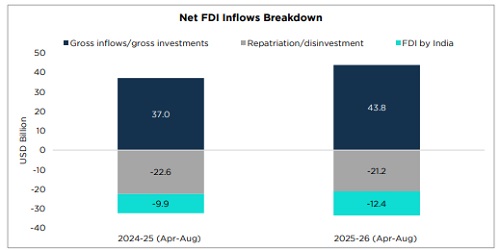

Foreign Direct Investment

Net FDI Inflows Pick Up

* Net FDI inflows (Gross inflows/gross investments - Repatriation/disinvestment - FDI by India) rose to USD 10.1 billion in 2026 FYTD (Apr–Aug), up from USD 4.6 billion in the corresponding period of FY25, driven by higher gross inflows (growth of 18% YoY in FYTD).

* We expect net FDI inflows to remain muted in FY26.

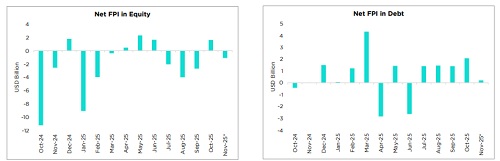

Trends in FPI

October Saw FPI Inflows; Marginal Outflows So Far in November

* October witnessed net FPI inflows of USD 4 billion (equity + debt), after witnessing outflows for four straight months. However, November has seen marginal outflows so far.

* On a CYTD basis, FPIs have recorded net outflows of USD 8.8 billion, driven by equity outflows of USD 17.1 billion, partly offset by debt inflows of USD 8 billion.

* Developments around the US–India trade deal will play a key role in shaping investor confidence going forward.

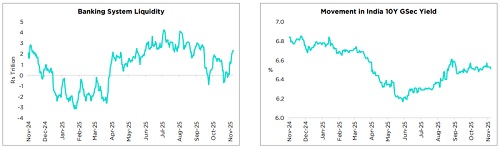

Liquidity & G-Sec Yield Update

Liquidity In Surplus; 10Y GSec Remain Elevated

* Banking system liquidity briefly slipped into deficit in late October, primarily due to GST outflows and an increase in currency in circulation amidst the festive season, but quickly reverted to a surplus owing to month-end inflows and the RBI’s support via VRR auctions.

* The WACR averaged 8 bps below the policy rate over the past month, reflecting comfortable liquidity conditions.

* In the near term, liquidity conditions are expected to remain comfortable supported by the remaining CRR cuts.

* India’s 10Y G-sec yield was largely flat over the past month. However, the yields remain elevated by 20-bps compared to six months ago.

* The outcome of the US-India trade negotiations will be closely monitored for its potential impact on market sentiment ahead of the RBI’s December MPC meeting.

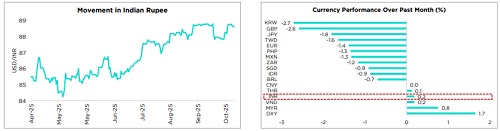

Currency Update

Rupee Appreciates Marginally

* The rupee appreciated marginally by 0.2% against the dollar over the past month, aided by renewed FPI inflows in October and expectations of a likely US–India trade deal.

* In the near term, the RBI’s intervention will contain rupee volatility.

* We maintain our FY26-end USD/INR forecast at 85–87, underpinned by a softer dollar, a firm yuan, a manageable CAD, and expectations around the US–India trade deal.

* Fed lowered its policy rate by 25 bps in October, mainly amidst labour market concerns. However, the governor signalled caution on the likelihood of a December rate cut.

* Dollar index has inched up by 1.7% over the past month but remains down ~8% CYTD. The recent uptick in the dollar index was largely due to hawkish commentary at the October Fed meeting.

Above views are of the author and not of the website kindly read disclaimer