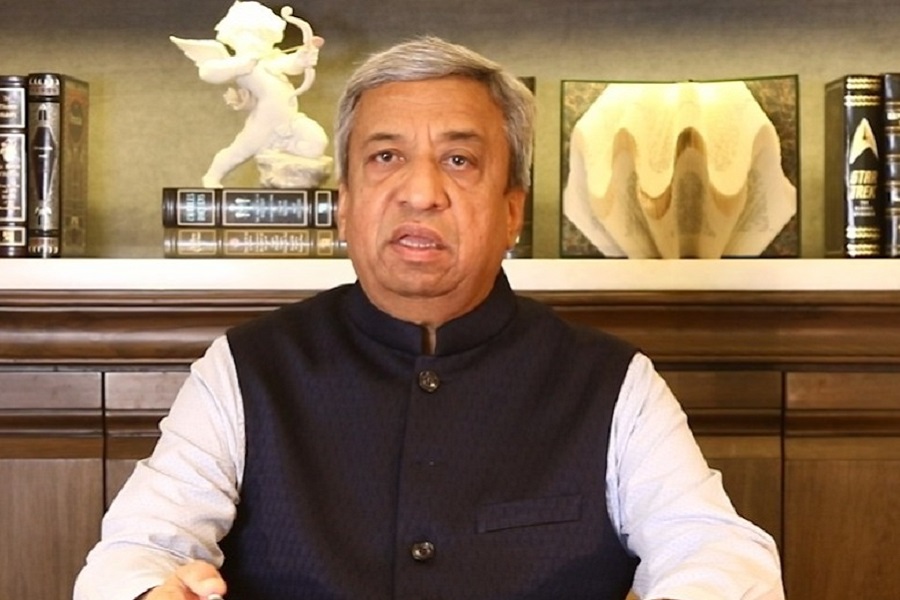

Diwali Picks 2023 By ARETE Securities

Diwali 2023 offers a perfect recipe for a strong, sustained upside in Indian Equities. Know why?

Since Diwali of 2021 until now, Nifty returns have been much muted. Nifty closed on 7/11/2023 at 19406, up only 9% from 17916.8 on Diwali 2021 (4/11/21). Yes, there have been significant returns on some internals, namely the entire PSU basket, be it defence, railways, utilities, capital goods, power, and power finance. Some sectors, like technology and metals (namely, sectors sensitive to global cues), have underperformed big time. It’s time for many sectors to catch up. We attribute the following reasons for this view:

• Despite the global geopolitical situation, crude is not posing a threat.

• Central banks around the world have paused rate hikes, indicating that even if there is a lag, rates can only head south.

• Inflation seems to be peaking out and may come off gradually.

• The dollar index now seems to be topping out around 107/108 levels.

• Corporate numbers are only improving with each quarter.

• FIIs have been heavily underweight Indian Equities, with the highest shorts. DII matching FII sell numbers is a positive. With the recent correction from 20200 to 18800, retail and prop are also very light on leverage trade.

• Above all, refer to the valuation matrix below. PEs can only expand and are not stretched at all, be they current, historic, or forward PE.

Above views are of the author and not of the website kindly read disclaimer

Please refer disclaimer at http://www.aretesecurities.com/

SEBI Regn. No.: INM000012740