Debt Market Observer Good Time to Be Bond Investor by Pankaj Pathak , Fund Manager, Quantum Mutual Fund

Below the quote on Debt Market Observer Good Time to Be Bond Investor by Pankaj Pathak , Fund Manager, Quantum Mutual Fund

Year 2023 can be characterised as a year of great volatility. Throughout the year, global bond market was toggling between two opposing narratives - “persistent inflation” and “recession” – particularly in the United States. Central bankers’ data dependency and volatile economic data too kept bond markets at the edge.

Going into 2024, outlook for the bond market and the fixed income as an asset class has improved greatly. There are many reasons to be positive on the bond market. We shall discuss some of them in subsequent sections.

For starters, the rate hiking cycle has peaked and the rate cutting cycle is about to begin. Inflation is cooling off along with slowing global growth. High interest rates, declining growth and heightened geo-political tensions have increased the risk of financial or economic shocks.

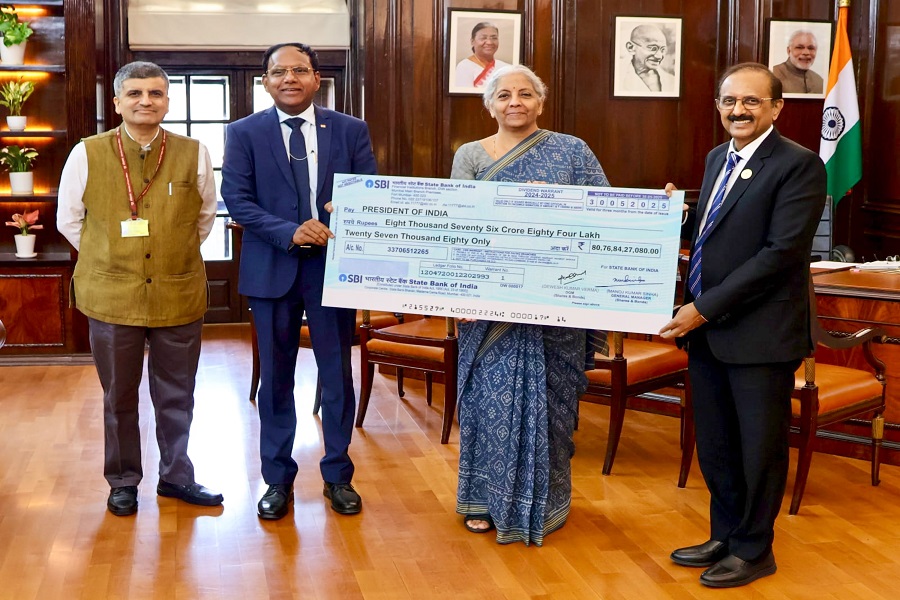

Domestically, demand supply dynamics in the bond market is looking more favourable with robust tax collections, government’s fiscal consolidation plan and India’s inclusion in the global bond index.

Monetary Policy – Heading for Reversal

Heading into 2024, central banks’ tone has begun to shift. In contrast to its higher for longer message just two months back, the US Fed has now readied itself to talk about rate cuts.

More importantly, it doesn’t see recession as a pre-condition for rate cuts; “just a sign that the economy is normalizing and doesn’t need the tight policy” will be enough for the FED to move.

The Dot Plot which indicates FOMC members’ projection for the Fed Funds rate, is now showing about 75 basis points (100 basis points = 1%) of rate cuts in 2024.

Chart – I: US Rate setting panel (FOMC) is indicating 75bps rate cut in 2024

Other major central banksarenot as explicit in their commentaries. Instead, some pushed back on the rate cut calls; like the ECB President Christine Lagarde countered - “We should absolutely not lower our guard”. And the BOE governor, Andrew Bailey, observed that “there is still some way to go” in the fight against inflation.

Nevertheless, they also highlighted that the full effect of higher interest rates is yet to come through. Therefore, they must remain vigilant to financial stability risks that might arise.

Overall, thepolicy undertone has turned less hawkish or incrementally dovish across the board indicating the worst of rate hiking cycle is now behind us.

Back home, the RBI governor Shaktikanta Das, for the first time in the last two years, cautioned to the risk of overtightening the monetary policy.

He alsonoted– “We have now reached a stage when every action has to be thought through even more carefully to ensure overall macroeconomic and financial stability; more so, because the conditions ahead could be fickle.”This is a big shift from the RBI’s policy making with Arjuna’s eye on inflation.

At this stage, the RBI seems more worried about potential shocks to the financial system and the growth outlook from fragile external environment. This will probably tilt the RBI’s reaction function more towards global macro environment and monetary policy cycle.

So, even if domestic inflation remains above 4%, the RBI might cut interest rates in response to worsening of global economic or financial conditions. Nonetheless, inflation outlook too looks supportive for the monetary policy.

The Core Disinflation

India’s Inflation trajectory has improved tremendously over the last few months though it didn’t get much attention due to volatile and generally high food prices which kept the headline CPI inflation elevated for most part in 2023.

As per the latest data, the headline CPI inflation stands at 5.6% in November 2023. As per the RBI’s projections, headline CPI inflation is expected to average at 5.4% in the fiscal year 2023-24.

However, if we strip out the impact of food prices, inflation for other goods and services (CPI ex-Food) now stands at 3.6%. Another popular measure - the Core CPI inflation, which excludes the food and energy prices has come closer to the RBI’s 4% target and is expected to slide down further in 2024.

Chart – II: Falling Core Inflation (ex-Food and Fuel) to ease pressure from the RBI

Although the RBI’s target is based on headline CPI, it would draw comfort from falling core inflation which tends to be more sticky.

As far as food inflation is concerned, monetary policy has a limited role to play. In this regard, the RBI worries more about the second-round impact of food inflation – high food prices feeding into inflation expectation and pushing up prices of other goods and services.

A crucial point to note here is that despite elevated food inflation, inflation expectations of Indian households have been very well anchored. As per the RBI’s inflation expectation survey, households’ perception of current inflation and expectations of future inflation have been coming down consistently in 2023 except for a marginal uptick in the one year ahead inflation expectation in November.

Chart – III: Despite elevated food inflation, household inflation expectation is very well anchored

To put this in context, there is no sign of second round inflationary impact of high food prices on inflation expectation or prices of core goods and services.

Thus, the RBI should not be overly worried about food inflation at this point. Having said that, this doesn’t open room for rate cut by itself. If at all, the RBI needs to cut rates in 2024, that would probably come in response to financial or economic shock from the external world.

From the market’s perspective, falling core inflation should lower the inflation risk premium on bonds by reducing the yield spread on government bonds over the policy repo rate. This in turn can bring down the bond yields even without a rate cut by the RBI. Any increase in the rate cut probabilities would further intensify the downward trend in bond yields.